Part II

Township Government By Illinois Law

By James Middleton

In the opening article of this series that had examined

township government in Illinois we sought to answer why

American government is arranged in layers of jurisdiction.

American government is arranged with overall coverage

by federal law followed by law that emerges from the

sovereign states. State law is further subdivided into

local units of government. The Federalist Papers was a

series of 85 essays written by James Madison, John Jay

and Alexander Hamilton that offered their view of how

an American government and a Constitution would be

conceived to create the democratic republican system of

governance that prescribes a series of division or layers

to attain a reasonable method to protect the public safety,

welfare and liberty.

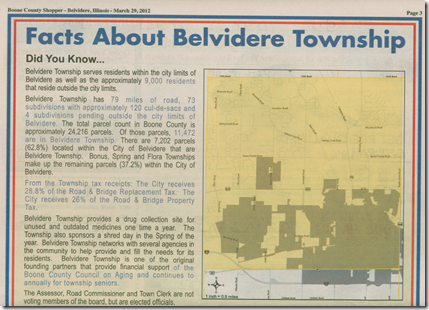

This second article examines local government and

townships. Local units of Illinois government are divided

between counties, townships and municipalities with

townships perhaps the least abstract and least understood

layer. Many wonder what townships actually do. Some

ask if townships are any longer relevant. Others ask why

there is a need for townships and claim that townships

are a redundant hold-over from an ancient day that more

resembles Medieval England than our “Internet Age.”

This second article examines township government

as identified in the Illinois Constitution and detailed in

the Illinois Compiled Statues at 60 ILCS 1—155. The

Compiled Statutes define how townships operate. Across

America there are 20 states like Illinois that retain townships

conforming to a variant common law scale of 36 square

miles in size. Some ask, without townships who cares for

rural roads, who aids the poor, who funds rural cemeteries

and who produces assessments of real property values—all

are responsibilities of Illinois townships.

**

The foundation of Illinois township government arises

in the Illinois Constitution at Article VII and in Section 5.

The Constitution identifies how townships are created and

how they may be dissolved;

“The General Assembly shall provide by law for the

formation of townships in any county when approved by

county-wide referendum. Townships may be consolidated

or merged, and one or more townships may be dissolved or

divided, when approved by referendum in each township

affected. All townships in a county may be dissolved

when approved by a referendum in the total area in which

township officers are elected.”

The question of a potential dissolution of a township has

arisen as an item of community interest here. It is in Section

5 that the Constitution identifies that dissolution can occur

under Illinois law.

Further, Section 11 specifies activities that require a

referendum be approved to decide certain questions that

may arise from a resolution enacted by a unit of government

or resulting from voter petition. In Belvidere, one city

alderman has sought to persuade his colleagues that the

city should enact a resolution supporting the idea that

an advisory referendum should seek voter approval to

determine if a majority of Boone County residents believe

that one township should be dissolved.

When this matter was presented to the City Council

during a Committee of the Whole meeting, the measure

passed by a vote of 7 to 2. However, the City Council later

voted to put the question on the table with no date certain for

reconsideration.

In Section 12 the Constitution stipulates:

“The General Assembly shall provide by law for the

transfer of assets, powers and functions, and for the payment

of outstanding debt in connection with the formation,

consolidation, merger, division, dissolution and change in

the boundaries of units of local government.”

Yet, this broadly viewed section does not answer

many questions regarding how the duties of a township would

be managed if dissolution occurred. These considerations

will be viewed in greater depth in the third piece of this

three-part series.

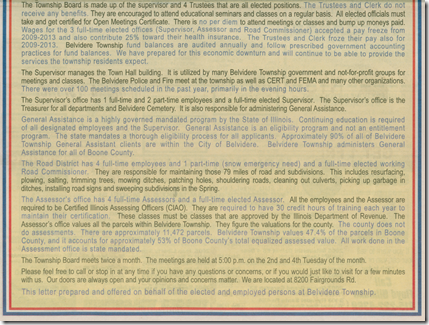

In a broad stroke, duties ascribed to Illinois townships

include maintenance of rural cemeteries and parks where

applicable, funding of aid to the poor and the elderly through

the general assistance fund, maintenance of township roads

and bridges and the assessment of real property values to

calculate the Equalized Assessed Valuation (EAV) of all real

property by which property taxes are based. However, there

are other duties enumerated at 60 ILCS 1/85-5, “Township

Corporate Powers, Generally.” The Code cites that “Every

township has the corporate capacity to exercise the powers

granted to it, or necessarily implied and no others. Every

township has the powers specified in this section.”

Some powers granted to townships include acquiring

property by purchase or gift, holding of property for rent,

Continued on page 15

entering into contracts with corporations, non-profit groups

or governmental entities. Townships may borrow money,

bring eminent domain actions, create law enforcement

and fire protection agencies, engage in sanitation and

pollution abatement activities, create public transportation

systems, libraries and other services. Article #85 indicates

that all of the enumerated powers of townships also carry

implied powers. Township powers are broad in nature

and compliment ideas promoted in the Federalist Papers

that state that local governmental entities have the closest

connection to the citizens.

The community has been awakened by Letters to the

Editor and news articles. One elected official proposed

entering a question on a general election ballot asking in an

advisory referendum if Belvidere Township government is

a redundant layer of government and should be dissolved.

The official contends that Belvidere residents do not benefit

from tax collections that accrue to Belvidere Township.

Some here support taking the next step after an advisory

referendum to have the question of dissolution placed

before county voters for them to decide.

However the trade organization “Township officials of

Illinois” contend that township spending has grown at a

slower rate than any other government since 1992. Further,

the group claims that townships, statewide, have the lowest

labor costs and that debt is almost non-existent in smaller

governments such as townships. Finally, townships,

according to the group, have exclusive geographic service

areas and this refutes the claim that too many local

governments provide duplicate services.

At 60 ILCS 1/25-5 the section identifies the law governing

the “Discontinuance of Township Organization.” To an

extent Article #25 mirrors citations from the Constitution

but this section identifies the actual steps that must occur

before discontinuance of townships within a county could

occur.

The Code at 60 ILCS 1/25-5 cites;

“Upon the petition of at least 10% of the registered

voters of each township of a county,,, the County Board

shall certify and cause to be submitted to the voters of the

county at the next general election, the question of the

continuance of township organization.”

This section does not mandate that a County Board must

recommend voter approval of a referendum to dissolve the

township unit of government. The section suggests, upon

certain legal thresholds being met, the County Board must

certify that the question of dissolution should be given to

the voters for them to answer.

The language of the proposition to be placed before

the voters would read, “Shall township organization be

discontinued in (the name of the county)?” If the proposition

fails to attain voter approval, four years must lapse before

the question is returned. A simple majority of the votes cast

is needed for the proposition to pass.

The Code at 60 ILCS 1/25-10 cites:

“If it appears by the returns of the election that a majority

of the votes in at least three-fourths of the townships,

containing at least a majority of the population in the

county, cast on the question of continuance of township

organization at the election are against the continuance of

township organization, then the township organization shall

cease in the county as soon as a county board is elected and

qualified. All laws relating to counties not under township

organization shall be applicable to the county, the same as if

township organization had never been adopted in it.”

At 60 ILCS 1/25-25, the Code identifies what should

occur when townships are dissolved;

“When township organization is discontinued, in any

county, the records of the several townships shall be deposited

From Page 4.... Township Government

in the county clerk’s office. The county commissioners

of the county may close up all unfinished business of the

several townships and sell and dispose of any of the property

belonging to the township for the benefit of the inhabitants

of the township, as fully as might have been done by the

townships themselves. The county commissioners may

pay all of the indebtedness of any township existing at the

time of the discontinuance of township organization and

cause the amount of the indebtedness, or so much as may be

necessary, to be levied upon the property of the township.”

However because a referendum was approved in a

general election ballot by a majority vote, that result does

not mean that the process of dissolution is finished. Myriad

elements of the process remain to be executed including a

method to distribute motor fuel tax that accrue to counties,

townships and municipalities according to differing systems,

how the general assistance fund would be managed without

township jurisdiction, or what would result for a township

assessor and road commissioner that are elective offices.

A popular claim has been voiced suggesting that residents

of Belvidere do not benefit from property taxes collected

by Belvidere Township but this claim is not supported by

fact. The website managed by the Boone County treasurer,

Curtis Newport, shows that funds are transferred annually

from Belvidere Township to the City of Belvidere.

In 2011Belvidere claimed they were due, for road and

bridge work that was executed by the city but that was the

responsibility of the township, $275,033.97. The county

clerk calculates the extension of revenue due the city and,

based upon property tax collections, the county treasurer

wrote a check for $274,676.72 that was extended to

Belvidere by Belvidere Township.

The county treasurer also reports that lesser amounts of

revenue from Bonus Township and Flora Township were

extended to the City of Belvidere for similar reasons.

Another means by which Belvidere residents benefit

from taxes collected by Belvidere Township is witnessed in

the management of the township general assistance fund that

aids the elderly and the poor. No unit of local government,

other than townships, is mandated under Illinois law to aid

the elderly and the poor other than townships. Further,

Belvidere Township grants funding through a contractual

relationship with the local chapter of the Salvation Army

that allows them to provide assistance to those in need from

Belvidere and Belvidere Township.

Providing financial assistance for those in need in Boone

County and in Belvidere is not a duty that accrues to the

city or the county. Providing public assistance is vested

with townships and state government through the general

assistance fund at the township level and public aid offices

as managed by Illinois. Both townships and Illinois state

government manage public aid and that absolves cities and

counties from offering similar levels or types of assistance

and that too could be construed as a benefit.

We have identified here township duties and

responsibilities. Illinois law provides for the merger,

combination and/or dissolution of municipalities and units

of government. Because the question has arisen regarding

the dissolution of township government this article has

focused on identifying the various steps that must occur

before dissolution of a township could result.

In the final part of this series we will examine the practical

results to residents if all townships in Boone County were

dissolved by popular vote. Some of the questions resulting

from a vote to dissolve townships have yet to be challenged

or decided within courts of law because such activities

attendant to a formal dissolution of a unit(s) of government

are rare.

Belvidere Chrysler Plant Featured on 60 Minutes

Belvidere Chrysler Plant Featured on 60 Minutes