As shown by the two documents that follow, Mark Todd was appointed(February 2011) County Treasurer when Christine Johnson filled the Illinois Senate District seat. The former bank vice-president ran unopposed in the November 2012 General Election as a Republican and resigned in December 2012 effective February 2013.

Mark Todd Quits County Treasurer Position

December 26, 2012 - Gov Watch - 2 comments

Apparently county board Chairman Jeff Metzger announced that DeKalb County Treasurer Mark Todd quit to pursue a job in Hawaii. That’s according to a news release sent to the Daily Chronicle. According to his Facebook page his wife got a great job there back in October.

Apparently county board Chairman Jeff Metzger announced that DeKalb County Treasurer Mark Todd quit to pursue a job in Hawaii. That’s according to a news release sent to the Daily Chronicle. According to his Facebook page his wife got a great job there back in October.

I’d take a better job in Hawaii. What an opportunity!

But the warm sunny skies and grass skirts of our 50th state didn’t influence this rant against the great injustice of it all. The press release should have come from Todd and it should have been posted on the County Treasurer’s website for all those that just voted in the election three weeks ago.

For this voter who filled in Todd’s slot on my ballot the Chronicle report read like a “wham bam thank you ma’am” letter direct from someplace near Honolulu.

“While the statutes do not provide specific qualifications for the office of county treasurer, I plan to develop criteria to evaluate candidates interested in this post so that the county is assured of getting a highly qualified individual to manage the treasurer’s office,” Metzger said in the news release.

Todd’s resignation will be effective Feb. 8 [2013], if the news release was accurate. He was appointed DeKalb County Treasurer back in February 2011. Long serving Christine Johnson left to fill the Illinois Senate District 35 seat vacated by Brad Burzynski’s retirement. He rain unopposed in the November 2012 election.

It would be more courteous, in my opinion, if elected officials shared their job pursuits with the public before election day instead of three weeks after. Especially in this job market. Had Todd announced his Hawaii intentions earlier who knows how many highly qualified candidates might have applied for the voters to choose from. Instead the deal will be done among party bosses or among those most connected. Maybe that’s what Metzger meant when he said that leading Republicans would step up and say why they wanted him for the county board chair. He won the seat by unanimous vote of the Democrats (plus his lone Republican vote).

Metzger will appoint the new DeKalb County Treasurer some time in the next 60 days (from Feb. 8). Evidently, state statutes require the appointment go to someone of the same political party as the vacating incumbent. Mark Todd was a Republican.

Feb 8. Why that date? Severance pay? Severance agreement?

Fair questions.

Above is from: Mark Todd Quits County Treasurer Position | DeKalb County Online

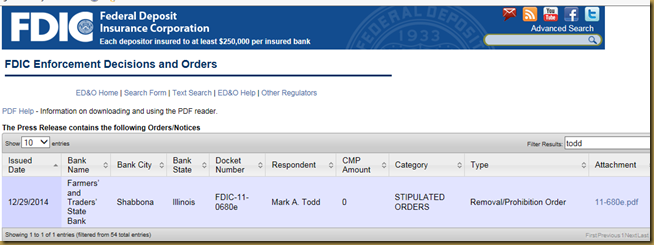

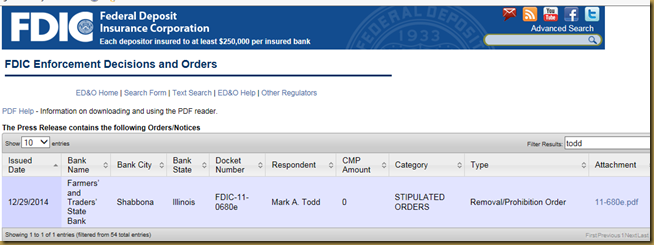

Mr. Todd was Vice-President of Farmers and Traders State Bank, Shabbona which was closed by the FDIC in June 2012. (see document below).

First State Bank, Mendota, Illinois, Assumes All of the Deposits of Farmers and Traders State Bank, Shabbona, Illinois

FOR IMMEDIATE RELEASE

June 8, 2012

Media Contact:

LaJuan Williams-Young

Office: 202-898-3876

Email: lwilliams-young@fdic.gov

Farmers and Traders State Bank, Shabbona, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with First State Bank, Mendota, Illinois, to assume all of the deposits of Farmers and Traders State Bank.

The two branches of Farmers and Traders State Bank will reopen on Saturday as branches of First State Bank. Depositors of Farmers and Traders State Bank will automatically become depositors of First State Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage up to applicable limits. Customers of Farmers and Traders State Bank should continue to use their existing branch until they receive notice from First State Bank that it has completed systems changes to allow other First State Bank branches to process their accounts as well.

This evening and over the weekend, depositors of Farmers and Traders State Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2012, Farmers and Traders State Bank had approximately $43.1 million in total assets and $42.3 million in total deposits. In addition to assuming all of the deposits, First State Bank agreed to purchase essentially all of the failed bank's assets.

Customers with questions about today's transaction should call the FDIC toll-free at 1-800-640-2607. The phone number will be operational this evening until 9:00 p.m., Central Daylight Time (CDT); on Saturday from 9:00 a.m. to 6:00 p.m., CDT; on Sunday from noon to 6:00 p.m., CDT; on Monday from 8 a.m. to 8 p.m., CDT; and thereafter from 9:00 a.m. to 5:00 p.m., CDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/ftsb.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.9 million. Compared to other alternatives, First State Bank's acquisition was the least costly resolution for the FDIC's DIF. Farmers and Traders State Bank is the 27th FDIC-insured institution to fail in the nation this year, and the second in Illinois. The last FDIC-insured institution closed in the state was Premier Bank, Wilmette, on March 23, 2012.

# # #

Above is from: https://www.fdic.gov/news/news/press/2012/pr12066.html

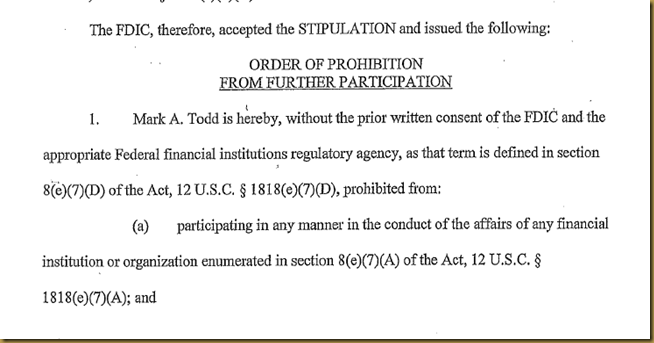

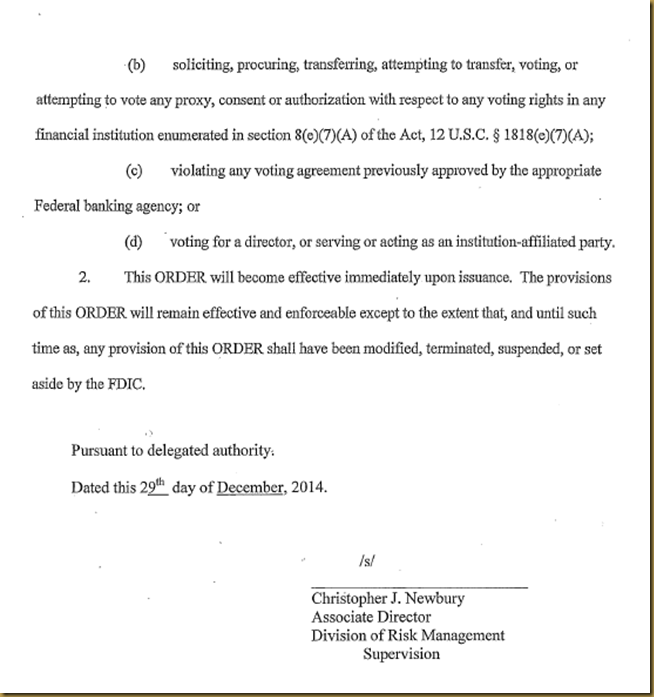

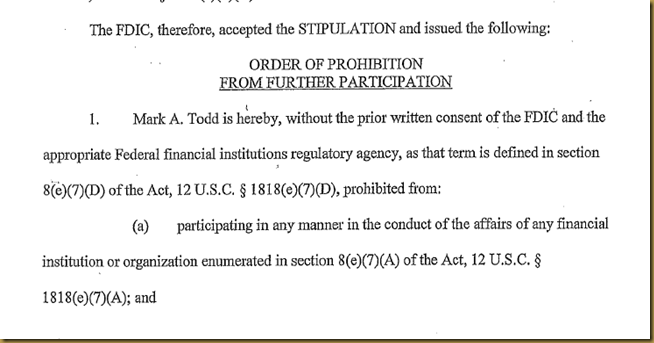

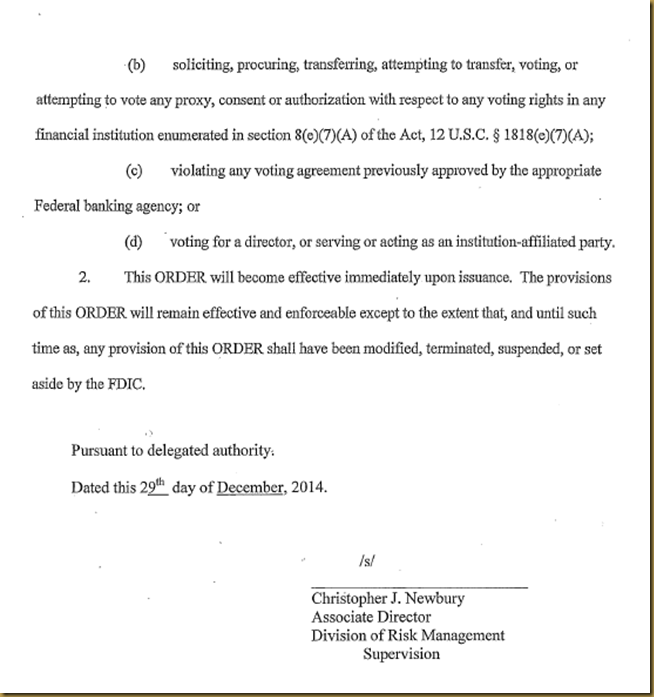

In December 2014 the following legal action was finalized by the FDIC. . As shown by the legal order, Mr. Todd is prohibited from bank ownership or conducting the affairs of a financial institution.

Above is from: https://www.fdic.gov/news/news/press/2015/pr15011a.html?source=govdelivery&utm_medium=email&utm_source=govdelivery

The above is the attachment from: https://www.fdic.gov/news/news/press/2015/pr15011a.html?source=govdelivery&utm_medium=email&utm_source=govdelivery