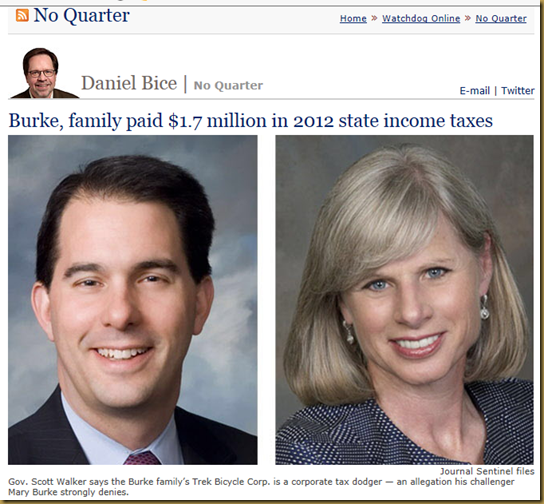

Gov. Scott Walker has attacked Democratic gubernatorial candidate Mary Burke and her family's bicycling business because it hasn't paid corporate income taxes to Wisconsin in decades.

Trek Bicycle Corp. is a tax-dodger, much to Burke's personal benefit, according to the GOP governor.

But Burke officials said Trek's owners — like many other businesses — pay taxes on the company's profits as individuals rather than through corporate taxes.

So exactly how much has the Burke clan forked over to the state?

A lot, it turns out.

Records show Burke, her mother and three siblings living in Wisconsin paid a total of $1.77 million in personal income taxes in 2012. That would mean the five Burke family members reported a total adjusted gross income of at least $22.8 million during that year.

It is not known what percentage of Trek is owned by the Burke family.

The company's largest individual shareholder, John Burke — Mary's brother and Trek's CEO — had a state tax bill of $841,781 in 2012. Given the state's top tax rate, he reported an adjusted gross income of at least $10.8 million that year.

The Burkes, in short, are a wealthy family with a healthy tax bill.

But Joe Fadness, executive director of the state Republican Party, suggested that Trek and its owners still aren't paying all they should. That's because Trek takes advantage of Subchapter S of the IRS code that allows the company to pass on its tax obligation to its shareholders at lower rates.

"At the same time millionaire Mary Burke didn't pay income taxes at several points, they (Trek officials) ironically boast about how they avoid paying their fair share of corporate taxes in order to pay a much lower rate by shifting the profits to shareholders," Fadness said.

Trek isn't the only company in the state that does this.

In fact, the majority of Wisconsin businesses operate as S corporations.

Many companies choose to do so to avoid what shareholders see as double taxation inherent in the traditional tax structure. That would mean the company pays a tax on its earnings, and then shareholders who receive a dividend must pay taxes on that income.

Joe Zepecki, spokesman for Burke, accused the governor of trying to "knowingly mislead" voters about a major Wisconsin business and its tax burden.

"As Mary has said from the start," Zepecki said, "Trek pays its fair share of taxes through its shareholders, just like 90% of Wisconsin businesses."

The tax information for the Burke family was obtained from the state Department of Revenue. Only the net income tax paid to the state is publicly available. The agency does not release other tax information, such as whether a taxpayer filed a joint or individual return.

John Burke declined to comment to No Quarter on his personal taxes.

But in a recent interview with Journal Sentinel reporter Bill Glauber, John Burke expressed dismay at the governor's criticism of Trek, saying the veteran politician understands how S corps work.

ADVERTISEMENT

John Burke also was surprised to find out that his tax information was publicly available.

"I'm not running for governor. My mother is not running for governor," he said. "Scott Walker can get my mother's taxes? Why?"

Records show Mary Burke paid $516,965 in state income taxes from 2008 to 2012. That would mean she reported an adjusted gross income of at least $6.8 million during that time. The figure could be much higher because her charitable donations result in large deductions on her tax bill.

In 2012, the Democratic candidate paid $120,316 in state income taxes. With the state's top tax rate of 7.75%, she would have reported an adjusted gross income of at least $1.5 million.

Her payment was more than 100 times the state average. Wisconsin collected $1,128 in state income taxes per state resident in 2011, according to the Tax Foundation.

Mary Burke's tax payments were the smallest of the five Burke family members living in Wisconsin. Each one has been paying a six-figure sum to the state annually in recent years.

Like her mother and siblings (she has one brother and two sisters in Wisconsin and one outside the state), Mary Burke's tax payments increased dramatically in 2008 after the death of her father, Richard, Trek's co-founder. His estate sold Trek stock to family members, meaning they were hit with increased taxes on the company's profits.

As a group, the five Wisconsin Burke family members coughed up more than $6.2 million in net state income taxes from 2008 to 2012.

The annual amounts paid by several individual family members now routinely exceed the most ever paid in a single year by Richard Burke. In 2005, he was nicked by the state for $244,467, his largest Wisconsin tax bill.

In 1998, the father stepped down as Trek CEO, turning over the reins to his son and focusing his time and efforts on creating the family's charity. The Burke Foundation, which gives money to a number of Milwaukee groups and schools, had a balance of nearly $117 million in 2012, according to tax records.

According to the state Department of Revenue, Mary Burke paid little state income taxes during her first stint working at Trek from 1990 to 1993 — a point of contention in the gubernatorial race. There is no record of a tax filing in 1994, a time when she took a yearlong sabbatical to go snowboarding in Argentina and Colorado.

Zepecki, the campaign spokesman for Burke, said she had no tax liability in 1990 because she lost money on some New York rental property, offsetting her Trek earnings. As for 1992 and 1993, she was living in Europe as Trek's head of European operations.

The federal government allows individuals living abroad for more than 330 days in a year to exempt foreign earnings up to a certain amount, thus lowering the amount of taxes owed. The figure was $70,000 for 1993.

Fadness, the GOP chief and Walker ally, has raised questions as to why Burke did not pay any state income taxes during these years. The Burke campaign has acknowledged making minor errors early in the campaign regarding her work history when discussing this issue.

Mary Burke "did not pay taxes at several points in her career at the same time middle-class families were working hard to put food on the table — something she is desperately trying to justify with lame excuses and repeated edits to her résumé," Fadness said.

But Zepecki said this is not an issue.

"Mary Burke has paid all the taxes she's owed," Zepecki said Friday. "Any suggestion to the contrary is completely false."

Above is from: Daniel Bice - Burke, family paid $1.7 million in 2012 state income taxes