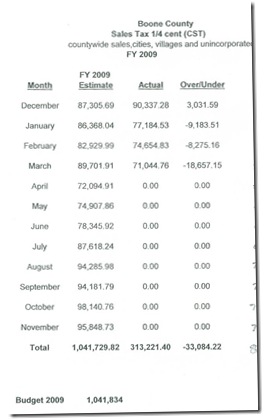

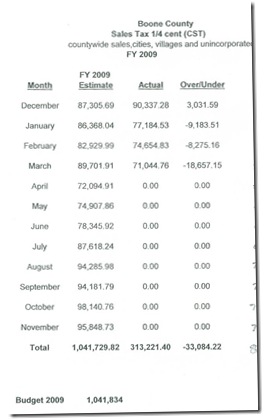

This is a continuation of a monthly analysis of Boone County’s non-real estate tax revenue flows. Although there are a few other minor revenues, the major revenue is from five sources: Public Safety Sales Tax (CPTS), Sales Tax 1/4 (CST), Sales Tax 1 cent (CT), Personal Property Replacement Tax (PPRT) and State Income Tax. All the raw numbers are those supplied by the County Administrator, Mr. Terrinoni, to the County Finance Committee. Click on the individual photocopies to make them larger.

To view previous months analysis go to : http://boonecountywatchdog.blogspot.com/2009/02/february-update-income-to-boone-county.html for February and http://boonecountywatchdog.blogspot.com/2009/01/income-reports-from-county-government.html for January 2009.

There is a continued downward trend, all five revenue streams are now short of projections. The shortages range from 8.3% to 26.92%; for those four revenues which occur monthly the range is 8.3 to 10.66%. Revenues from the five sources are down 10.75% from projections. Total revenue from these five sources is increasingly downward—January -4.27%, February –7.6% and now for March - 10.75%.

The accumulated shortage is now $198,942. The original budget indicated that if there was a recession, a $300,000 deficit to the original budget was probable. Back in January[click on the citation that follows to read the entire story http://www.rrstar.com/boone/x1621254117/Boone-officials-expect-budget-shortfall], Finance Committee Chairman Karl Johnson was paraphrased by the Rockford Star as saying : holding off on spending might not be enough to make up for a shortfall, but officials want to monitor income and the effect of reduced spending through at least April before making any major moves. I contacted the County’s Assistant Administrator and apparently department discussions concerning budget revisions are going to begin in May 2009. So that January statement appears to be still in effect.