Just received the actual numbers being reported to Boone County Finance Committee regarding its monthly revenue. I hope to use these monthly reports to keep everyone aware of county finances in this troubled time.

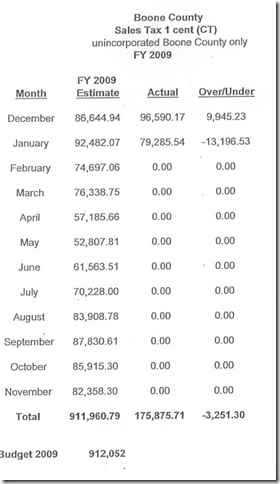

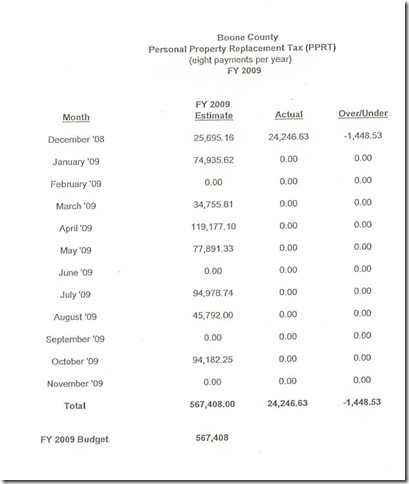

There are five main sources of taxation. Each of the five sheets will enlarge if you click on it. As of now the county is down $33,188.78 or 4.27% of December/January projected revenue.

Here is the calculation from these sheets:

Shortfall/Overages: -3251.30+-6151.92+6814.54+-1448.53+-29151.57=-33,188.78

Actual Revenues: 175875.70+167542.81+293002.26+24246.63+84119.31= 744765.71

Projected Revenue=744765.71+33188.78=777954.49

Shortage is 33188.78/777954.49= 4.27%

Analysis of the trends in these various accounts is still quite difficult. Of most concern is the State Income Tax (immediately above) it is down 25.7%. State Income Tax is 31.2% of the total $6,053,704 of tax revenue, however figures are only for December. One Cent Sales Tax is down 1.8%, 1/4 Cent Sales Tax is down 3.5%, Public Safety Sales Tax down 2.4%, Personal Property Replacement Tax down 5.6%. Most of these taxes are collected by the state in a prior month therefore further decreases may be possible based upon the continued downturn in the economy.

No comments:

Post a Comment