Fiat's temporary shutdown, announced on Tuesday, and set to take effect on February 22, is "not appropriate," Scajola said, stressing that the move came as unemployment is a key issue in Italy.

Fiat's temporary shutdown, announced on Tuesday, and set to take effect on February 22, is "not appropriate," Scajola said, stressing that the move came as unemployment is a key issue in Italy.

The company's move comes "during these very days that we are dealing with the delicate issue of Termini Imerese," Scajola, said in an interview with news television channel SkyTG24.

Fiat Chief Executive Officer Sergio Marchionne, recently announced that the Turin-based company intends to permanently close its plant in Termini Imerese, Sicily by the end of 2011.

Prime Minister Silvio Berlusconi's conservative government has repeatedly urged Fiat to reconsider the move which - if implemented - could render some 1,600 workers jobless.

Fiat's decision on the country-wide temporary stop, "could be interpreted by some as blackmail," said the CISL labour union's General Secretary Raffaele Bonanni, referring to ongoing negotiations with the carmaker over the fate of Termini Imerese.

Read more: http://www.earthtimes.org/articles/show/306082,italian-government-slams-fiat-for-halting-production.html#ixzz0gKt9m2oS

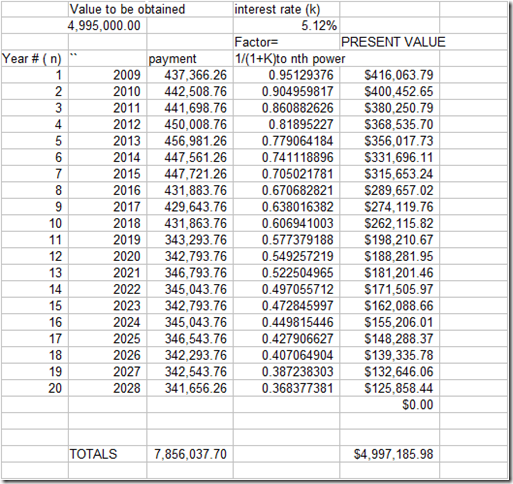

As noted by the minutes of Finance Sub-committee shown below, the Boone County Board is considering refinancing several million dollars of bonds. [Series 2008 A & B, see paragraph 2] The 2008 Bonds had $205,000 in underwriting cost. Now the Board is considering refinancing and incurring a like amount of underwriting cost? Does this make sense? Is the county doing this only because it cannot afford to pay the current debt schedule out of the General Fund? These projects were going to be paid out of savings and operating income, why the change? Does refinancing really make economic sense?

As noted by the minutes of Finance Sub-committee shown below, the Boone County Board is considering refinancing several million dollars of bonds. [Series 2008 A & B, see paragraph 2] The 2008 Bonds had $205,000 in underwriting cost. Now the Board is considering refinancing and incurring a like amount of underwriting cost? Does this make sense? Is the county doing this only because it cannot afford to pay the current debt schedule out of the General Fund? These projects were going to be paid out of savings and operating income, why the change? Does refinancing really make economic sense?

![[image[8].png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhEUhl9wm58Ttjn40zhH_hTrWFd0i9Y1hudG_dpJKrEMumrhd6vuf7_up_-Eg-NHVETAtWgdafru7bh-IWJphz8Isp7GwWP9GBBgGL5T9XH54xEl3Vv-fVEdzo3ciYYWeV6Q0ijyEYl9Cw6/s1600/image%5B8%5D.png)