As noted by the minutes of Finance Sub-committee shown below, the Boone County Board is considering refinancing several million dollars of bonds. [Series 2008 A & B, see paragraph 2] The 2008 Bonds had $205,000 in underwriting cost. Now the Board is considering refinancing and incurring a like amount of underwriting cost? Does this make sense? Is the county doing this only because it cannot afford to pay the current debt schedule out of the General Fund? These projects were going to be paid out of savings and operating income, why the change? Does refinancing really make economic sense?

As noted by the minutes of Finance Sub-committee shown below, the Boone County Board is considering refinancing several million dollars of bonds. [Series 2008 A & B, see paragraph 2] The 2008 Bonds had $205,000 in underwriting cost. Now the Board is considering refinancing and incurring a like amount of underwriting cost? Does this make sense? Is the county doing this only because it cannot afford to pay the current debt schedule out of the General Fund? These projects were going to be paid out of savings and operating income, why the change? Does refinancing really make economic sense?

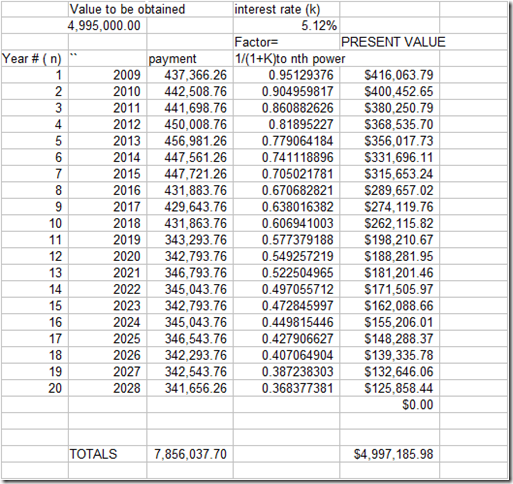

Back in January 2009 I posted a length analysis regarding the high “hidden” cost” of Boone County’s borrowings for the Administrative Center on Logan and the remodeling at the Courthouse. See: http://boonecountywatchdog.blogspot.com/2009/01/paying-bondsman.html. To review those findings: the county borrowed $5.2 million, only received $4,995,000 because of $205,000 in various underwriting cost, primarily insurance on the bonds. Because the net proceeds to the county were lower than the face amount of the loan the effective interest rate of the $4,995,000 borrowing was approximately 5.12%. That rate equaled the rate for conventional home mortgage loans to a good credit.

Now the county is proposing to spend more money to a bond broker to find out how much it will cost to refinance the bond? Will the county board really consider all of the cost of refinancing?

Click on photocopy to enlarge:

![[image[8].png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhEUhl9wm58Ttjn40zhH_hTrWFd0i9Y1hudG_dpJKrEMumrhd6vuf7_up_-Eg-NHVETAtWgdafru7bh-IWJphz8Isp7GwWP9GBBgGL5T9XH54xEl3Vv-fVEdzo3ciYYWeV6Q0ijyEYl9Cw6/s1600/image%5B8%5D.png)

No comments:

Post a Comment