The Rockford Register Star just published this handy graph concerning census results. And it looks like that Belvidere is over the “25,000” magic number and will now automatically become a “home rule” community.

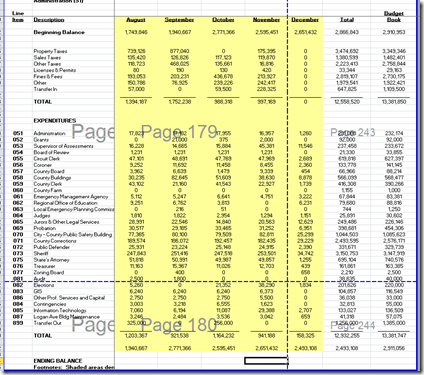

Click on the photocopy to enlarge:

The following is a brief summary of the facts regarding Belvidere’s new status. They are taken from the Village of Lake Forest, a very wealthy North Shore community. Lake Forest was a community which was under 25,000 which ran a referendum in 2005 to obtain home rule. Item in red shows the action that Lake Village City Council did to assure its citizens of real estate tax limits. Belvidere will have not such limit. In blue at the very bottom is the legal citation for a home rule community in Illinois. The community’s new rights as well as how to opt out of home rule are outline. Rockford is an example of a community which opted out of home rule.

WHAT IS “HOME RULE”?

Under the 1970 Illinois Constitution, Home Rule shifts decision making from the state level (Springfield) to the local level (Lake Forest) enabling communities to find local solutions to local problems.

Home Rule communities are granted a broad range of powers for the local good unless exempted by the State. Often a Home Rule community is exempted from meeting requirements mandated by state legislation.

HOW DOES A COMMUNITY BECOME HOME RULE?

Municipalities with populations over 25,000 are automatically granted Home Rule status, while smaller communities can put the question on a ballot and let voters decide. The majority (over 70%) of Illinois’ 12.5 million citizens live in Home Rule communities. Among Illinois communities having Home Rule, 55% attained Home Rule status by voter approval of a Home Rule referendum, such as the one on the November 2, 2004 ballot. No community has petitioned to revoke Home Rule status in the past 20 years.

WHAT NEARBY COMMUNITIES ARE HOME RULE?

Deerfield Gurnee Mettawa Skokie

Evanston Highland Park Mundelein Waukegan

Glenview Lincolnshire Northbrook Wilmette

Currently, several other North Shore communities like Lake Forest are considering voter approval of Home Rule status.

WHY IS LAKE FOREST CONSIDERING HOME RULE?

If approved by the voters, Home Rule will provide the City with additional flexibility and local control for maintaining the character of our community. It would enhance the City’s ability to preserve the integrity of its zoning ordinances, to operate in a more cost-effective manner, and to have a more diversified and flexible revenue base that could reduce dependency on property taxes.

WHAT ARE THE BENEFITS OF HOME RULE?

The adoption of Home Rule would provide Lake Forest greater protection from state mandates and the ability to solve problems at a local level. Specifically, major benefits frequently associated with Home Rule are threefold:

Maintaining Community Character

Home Rule would mean that the State of Illinois cannot intercede as a super zoning authority. The City would retain local control over zoning issues instead of allowing petitioners to go to the State for final

decisions on such things as affordable housing, day care, etc. Petitions would come directly to the City and go through the local public hearing process for a decision. This local process gives residents the opportunity to review petitions that directly impact their property. Lake Forest would have direct control over important issues that impact property values and community character.

Increased Financial Flexibility Lake Forest’s long-term financial stability is being impacted by decreasing revenues (tax cap limitation and a reduction in state revenues, development fees and sales taxes) coupled with increasing expenses (higher

insurance, pension and health care costs, aging infrastructure, and additional state mandates). Home Rule is not only a flexible tool that endorses local decision making; it enables sound long-term fiscal planning.

Home Rule would provide Lake Forest with the flexibility to explore new funding sources, such as a licensing fee for service businesses (banks, landscapers, etc.), restaurant tax, real estate transfer tax, etc. Home Rule status would also allow the City to use the existing Hotel Tax revenue for infrastructure (streets, sewers, etc.) instead of limiting its use solely to tourism. Home Rule communities have more flexibility in regard to debt offerings often resulting in lower interest rates and a strengthened bond rating.

Reduced Regulation from State Mandates

Home Rule can afford Lake Forest greater protection against state control, such as the recently enacted Affordable Housing Act. Under that Act, Lake Forest could be required to increase its overall percentage of affordable housing to 10%, or approximately 330 new units. If Lake Forest were Home Rule, it could still support this important initiative but at a level that more appropriately addresses our community’s needs. State legislatures often impose unfunded mandates on local governments to provide certain services that fail

to provide a revenue source to offset the cost of those services.

WHAT ARE THE POTENTIAL DISADVANTAGES OF HOME RULE?

Home Rule gives local government greater discretion to generate revenues through issuing bonds and

increased taxes -- i.e., property and sales tax increases, restaurant tax, real estate transfer tax, etc.

Home Rule permits greater local control over decision making without state oversight and without certain

procedural limitations.

WILL PROPERTY TAXES INCREASE UNDER HOME RULE?

Based on the research of Professor James Banovetz, widely regarded as the foremost expert on Home Rule in Illinois, there is no evidence that Home Rule municipalities have higher or faster growing property taxes than comparable non-Home Rule municipalities. In fact, Home Rule status is often used to shift the tax burden from property taxes to other revenue sources, such as licensing fees, restaurant tax, real estate transfer tax, etc. This would diversify the revenue base and reduce the burden on property owners. Indeed, communities that have adopted Home Rule status have seen their property taxes increase at a lower rate than non-Home

Rule communities. The City Council has recognized the concern of residents about increased taxing authority. In early August 2004, the City Council adopted an ordinance to continue to adhere to the property tax limitations commonly referred to as the “property tax cap.” The only exceptions to this limitation would be if an emergency or legal requirement dictates an increase or if the residents approved a referendum for an increase beyond that called

for under tax cap legislation. Additionally, under a proposal before the City Council, if Home Rule authority is approved by the voters, any increase in tax rates would require two public meetings and a super-majority

(two-thirds) vote of the City Council.

THE ILLINOIS 1970 CONSTITUTION:

SECTION 6. POWERS OF HOME RULE UNITS

(a) A County which has a chief executive officer elected by the electors of the county and any municipality which has a population of more than 25,000 are home rule units. Other municipalities may elect by referendum to become home rule units. Except as limited by this Section, a home rule unit may exercise any power and perform any function pertaining to its government and affairs including, but not limited to, the power to regulate for the protection of the public health, safety, morals and welfare; to license; to tax; and to incur debt.

(b) A home rule unit by referendum may elect not to be a home rule unit.

(c) If a home rule county ordinance conflicts with an ordinance of a municipality, the municipal ordinance shall prevail within its jurisdiction.

(d) A home rule unit does not have the power (1) to incur debt payable from ad valorem property tax receipts maturing more than 40 years from the time it is incurred or (2) to define and provide for the punishment of a felony. (e) A home rule unit shall have only the power that the General Assembly may provide by law (1) to punish by imprisonment for more than six months or (2) to license for revenue or impose taxes upon or measured by income or earnings or upon occupations.

(f) A home rule unit shall have the power subject to approval by referendum to adopt, alter or repeal a form of government provided by law, except that the form of government of Cook County shall be subject to the provisions of Section 3 of this Article. A home rule municipality shall have the power to provide for its officers, their manner of selection and terms of office only as approved by referendum or as otherwise authorized by law. A home rule county shall have the power to provide for its officers, their manner of selection and terms of office in the manner set forth in Section 4 of this Article.

(g) The General Assembly by a law approved by the vote of three-fifths of the members elected to each house may deny or limit the power to tax and any other power or function of a home rule unit not exercised or performed by the State other than a power or function specified in subsection (l) of this section.

(h) The General Assembly may provide specifically by law for the exclusive exercise by the State of any power or function of a home rule unit other than a taxing power or a power or function specified in subsection (l) of this Section.

(i) Home rule units may exercise and perform concurrently with the State any power or function of a home rule unit to the extent that the General Assembly by law does not specifically limit the concurrent exercise or specifically declare the State's exercise to be exclusive.

(j) The General Assembly may limit by law the amount of debt which home rule counties may incur and may limit by law approved by three-fifths of the members elected to each house the amount of debt, other than debt payable from ad valorem property tax receipts, which home rule municipalities may incur.

(k) The General Assembly may limit by law the amount and require referendum approval of debt to be incurred by home rule municipalities, payable from ad valorem property tax receipts, only in excess of the following percentages of the assessed value of its taxable property: (1) if its population is 500,000 or more, an aggregate of three percent; (2) if its population is more than 25,000 and less than 500,000, an aggregate of one percent; and (3) if its population is 25,000 or less, an aggregate of one-half percent. Indebtedness which is outstanding on the effective date of this Constitution or which is thereafter approved by referendum or assumed from another unit of local government shall not be included in the foregoing percentage amounts.

(l) The General Assembly may not deny or limit the power of home rule units (1) to make local improvements by special assessment and to exercise this power jointly with other counties and municipalities, and other classes of units of local government having that power on the effective date of this Constitution unless that power is subsequently denied by law to any such other units of local government or (2) to levy or impose additional taxes upon areas within their boundaries in the manner provided by law for the provision of special services to those areas and for the payment of debt incurred in order to provide those special services.

(m) Powers and functions of home rule units shall be construed liberally. (Source: Illinois Constitution.)

SECTION 11. INITIATIVE AND REFERENDUM

(a) Proposals for actions which are authorized by this Article or by law and which require approval by referendum may be initiated and submitted to the electors by resolution of the governing board of a unit of local government or by petition of electors in the manner provided by law.

(b) Referenda required by this Article shall be held at general elections, except as otherwise provided by law. Questions submitted to referendum shall be adopted if approved by a majority of those voting on the question unless a different requirement is specified in this Article. (Source: Illinois Constitution.)

Oh yes: Lisle, Lombard, Villa Park, Rockford and other Illinois communities have voted home rule out in favor of taxpayer referendum on large fiscal matters!

![26325719[1] 26325719[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhm7kel-zE18Ajzox0yfR1oo4l9gTHIUeDkgM3wpEE-MyXocmrcrLOMmbJu0PtrIpdC4XnS1Nt5A1y5ijdNpQcFIqcc-wSuR_ydx5POiYF9iro0qgufLcxDNnsU2I3RvMtzHTUOWGoi5KB2/?imgmax=800)