Here is what Mr. Zielinski said to Cal Skinner’s McHenry County Blog.

Al Zielinski Staying as Grafton Township Assessor

Posted on 01/05/2018 by Cal Skinner

This is a press release from Grafton Township Assessor Al Zieliniski:

Four more years of accurate and fair assessments for Grafton Township

HUNTLEY, IL – Grafton Township property owners can look forward to four more years of accurate and fair assessments based on Al Zielinski’s decision to take his oath of office for the 2018 through 2021 term.

Zielinski’s first term as Grafton Township Assessor ran from January, 2014 through December, 2017.

He won re-election in 2017 as a write-in candidate.

An amazing team of professionals generating exemplary results

“Grafton Township is blessed to have skilled and experienced professionals making its valuations.” said Zielinski.

“Based on my emphasis on continuing education and the township’s investments in its Deputies, Grafton has one of the most qualified assessment staffs in the state.

“We have

- one Certified General Appraiser (the highest appraiser designation in the state)

- one CIAO-S (the second highest designation offered by IPAI, the Illinois Property Assessment Institute) and

- two CIAO-I designations (the third highest designation offered by the IPAI).

Given our focus on using the market approach to value and our openness to review and revise assessments each year, property owners can rest assured their assessments are truly based on current market values.”

Focusing on Grafton Township

When asked about his decision to relinquish his appointment as Boone County’s Chief Assessment Officer, Zielinski was forthright.

“I was told I was too blunt with the township assessors. I

“don’t know how anyone can demand absolute compliance with the Illinois Property Tax Code, the Board of Review’s Rules and his/her oath of office in a more delicate manner.

“Because the County Board was unwilling to accommodate my commitment to excellence so we could achieve results similar to Grafton, it accepted my resignation.

“I achieved a lot in my time there creating processes that will help them improve future accuracy and equity.

“They have my best wishes.”

Looking to the future and building on an established record

Based on the 2017 results obtained from McHenry County, Grafton Township has consistently exceeded the Illinois Department of Revenue’s accuracy (sales ratio) and equity (coefficient of dispersion) specifications for each of the four years during Zielinski’s first term.

“We’re not resting on our laurels.

“To th

Comments

Al Zielinski Staying as Grafton Township Assessor — 17 Comments

ss on 01/05/2018 at 12:14 pm said:

SH*T

HonestAbe1 on 01/05/2018 at 12:52 pm said:

Accurate and fair ?

That’s a joke, right Al ?

Hey Al, if you haven’t noticed or have been in a

coma for the past few years, Huntley home owners

have been fleeing in record numbers year after year.Why is that, Al ?

HonestAbe1 on 01/05/2018 at 12:57 pm said:

The Land Of Leaving ….

https://www.illinoispolicy.org/land-of-leaving-moving-companies-rank-illinois-no-1-for-outbound-vans/Al Zielinski on 01/05/2018 at 1:04 pm said:

No joke (unless one thinks the Department of Revenue’s accuracy and fairness metrics are laughable – which they aren’t).

Assessments and taxes are not directly correlated.

Assessments could be cut by half and property taxes would be the exactly same because the tax rate would double.

The driving force behind the tax rate is the numerator (levy) not the denominator (EAV).

What our accuracy and fairness provide is a bright, clear light allowing focus on the levy.Grafton Taxpayer on 01/05/2018 at 1:05 pm said:

That’s right!

Al Zielinski resigned from a job paying over $70k to stay on a job that pays….less than half of that! And you were so intent on quitting that Boone job that….you held the Annual Boone Assessors meeting less than three weeks ago, which is a meeting to discuss the upcoming assessment year.

http://www.boonecountyil.org/news/public-notice-2017-annual-assessors-meeting

I’m sure Al wasn’t fired at all.

And now he returns to a job position that…he didn’t want to have replaced after he left! (He was recommending that the office not replace his position, but roll his responsibilities over to a Deputy Assessor) so he’s really useful and consistent around here. And again, it wasn’t his fault in Boone, it was those darn non-compliant township assessors. I wonder how you deal with those. I mean, I know one that was sued and told to resign from the Grafton Township board multiple times.

We have all the reason to believe you Al. Since you’ve done nothing but lie to us so far.

Bald_Eagle on 01/05/2018 at 1:47 pm said:

Time to end townships.

Currently the county board has the power to put a referendum on ballot.

Franks what are you waiting for?

Al Zielinski on 01/05/2018 at 3:48 pm said:

“I’m sure Al wasn’t fired at all.”

At least that part is accurate.35 ILCS 200/3-10 is very clear.

“The county board, by a vote of 2/3 of its members, may dismiss a supervisor of assessments before the expiration of his or her term for misfeasance, malfeasance or nonfeasance in the performance of the duties of the office.”Since none of those occurred, it wasn’t a “firing” but a resignation as stated.

Hopefully some readers can/will relate to the fact that honor still takes precedence over salary.

Thank you for providing the link to the Assessors’ Meeting.

That same page provides a link to the presentation that was made.

After reading it, it’ll be clear that:

– compliance (as conveyed in the press release) was a critical fundamental and

– my honor and integrity have always been, and remain, inviolate.AlabamaShake on 01/05/2018 at 4:04 pm said:

**Huntley home owners have been fleeing in record numbers year after year.**

Something tells me it isn’t because of property assessments.

Truth2Power on 01/05/2018 at 4:20 pm said:

Townships must go. 17 Counties got rid of them and the pension losers that go with them.

Grafton Taxpayer on 01/05/2018 at 5:02 pm said:

You know it’s funny Al.

– You “resigned” from a job and went back to one that was half the salary. Over Integrity? Do you really think we were born yesterday? By the way, were you drawing a pension over there? And when did you start drawing a full time salary over there?

– There was a Closed Meeting on December 19th in Boone County that was a “Special Finance, Taxes and Salaries Committee Meeting.” Before that meeting, your name was on the Boone website. Not long after that meeting, your name was off the website. The minutes will eventually be released from said meeting. I’m sure the minutes will not undermine the supposed ethical unicorn that you are.

https://www.boarddocs.com/il/boone/Board.nsf/Public

(You’ll have to click a meeting and scroll to 2017)

– You point fingers at everyone. You’ve pointed fingers at the Grafton Board, The County Assessor, the Grafton Township Attorney, Grafton citizens, and now Boone County. (I’m pretty sure you’ve pissed off the Mchenry County Board of Review too.) Everyone else is dishonest and corrupt except you. Here’s a hint: Honest people don’t pass blame to literally everyone else.

But the pathetic facade you attempt to present in this blog is hilarious.

Grafton Taxpayer on 01/05/2018 at 7:38 pm said:

Hey Al…another thing. You can keep pointing the finger at the tax levies for people moving, but like it or not you are the most powerful person in the taxing process. And people would rather move than deal with your line of idiocy. There was even a homeowner interviewed by the Northwest Herald that had sold his home in Huntley and moved to Florida. And what was one of the moving factors? When you jacked his home value in that illegal 2014 reassessment. It’s funny how you keep touting accuracy, from your woefully underassessed 1.4 acre estate.

And the funny thing is…there is probably a reason you never flat out quit Grafton and went to Boone. In the private sector, you give your two weeks notice and leave one job before going to another. And most people in the government sector do that too. The Grafton Board told you multiple times to resign. But you kept your foot in the Grafton door didn’t you? Down deep, you probably knew the people at Boone might find out if you were a squib. And I’m guessing they did.

AlabamaShake on 01/05/2018 at 9:40 pm said:

**like it or not you are the most powerful person in the taxing process.**

I have absolutely no skin in the Al game.

I don’t have a side.

But… this attack is asinine.

If you really think that the assessor is the most powerful person in the taxing process, you’re either blatantly lying or intentionally ignorant.

The assessor assesses the value.

He/she does not set tax levels.

This isn’t hard to understand.

Billy Bob on 01/05/2018 at 10:47 pm said:

In the aggregate, it’s a zero sum game, but to the individual homeowner, a bad assessment will have a far greater effect on his or her property tax bill than the tax rate.

Grafton Taxpayer on 01/05/2018 at 11:08 pm said:

Alabama Shake…first I’m glad you don’t have skin in this game. Jealous.

The problem with the Grafton assessor is his failure to assess uniformly through the township.

He showed preference to certain neighborhoods by lowering their assessments and shifted a tax burden to others when he raised theirs.

That is power in the taxing process.

One citizen had to sue for neighborhood data because Z wouldn’t give what should be very public neighborhood information. (The citizen got the data. one thing found out: Z lowered values in his neighborhood despite sale prices rising in the same period.)

And the fun part is a citizen can’t do much more than appeal their own home value…but not appeal with homes outside their neighborhood.

You will hear him spout how he the numbers fit all his way, and how hes a man of integrity.

He will spin and spin and spin.

But notice how he doesn’t post data.

And do you trust a guy by what he says or what he does?

Try asking him hard questions and see how far you get.

Cal Skinner on 01/06/2018 at 12:40 pm said:

I can’t speak to the micro (neighborhood) data, but the margin of error (Coefficient of Dispersion) inGrafton Township last year was second lowest in McHenry County.

Grafton Taxpayer on 01/06/2018 at 1:45 pm said:

Cal…Grafton had the lowest Coefficient of Dispersion in McHenry long before Z took over.

There is fairly uniform housing compared to other townships, (Del Webb for example) which leads to a lower COD anyway.

Also…Z fails at another key metric: the Sales Assessment Ratio. Don’t forget, the target ratio is 33.3%. Well, in 2014, the year Z (illegally) reassessed, the Raw Median was 31.16%. IN 2015, when he reassessed for the Quadrennial, the sales ration was WORSE at 29.06%.

This is stupid for a few reasons:

– His rationale for reassessing in 2014 was because some neighborhoods fell to 29% or 31% sales ratios. So why was it so bad in 2013, but acceptable when he took over?

– The Grafton Sales Assessment ratio in 2013, the year before Z took office, was 33.6%. JUST 0.3% FROM THE TARGET. And the COD was lowest in the county too. That’s about as close to perfect as you can be. Yet Z comes in one year before the Quadrennial, and says “We need to reassess” and then the sales ratio drops under Z, and then drops again?

Here’s the link to the IDOR Sales Ratio numbers in 2013 (You need to scroll down a few pages)

http://www.revenue.state.il.us/AboutIdor/TaxStats/PropertyTaxStats/Table-1/2013-AssessmentRatios.pdf

– And don’t forget…some neighborhoods got RAISED values in 2014. Meanwhile other neighborhoods definitely dropped. Who got some shade? And what happened when a citizen asked for neighborhood data? He had to take Z to court.

The premise that Z is accurate is a blatant lie where he cherry picked some numbers.

Al Zielinski on 01/06/2018 at 3:14 pm said:

If, as the proposed wizard of statistics Grafton Taxpayer opines, the Coefficient of Dispersion is truly related solely to “fairly uniform housing compared to other townships,” how could Burton Township, with its much greater diversity of housing, be the only township to have a lower CoD than Grafton for 2017?

If someone is going to spout statistics, one should know (at least a little) of what they speak (especially when their commentary relates to what happened three and four years ago).

What I said.

“Based on the 2017 results obtained from McHenry County, Grafton Township has consistently exceeded the Illinois Department of Revenue’s accuracy (sales ratio) and equity (coefficient of dispersion) specifications for each of the four years during Zielinski’s first term.”

TRUE based on Department of Revenue statistics which don’t “spin” and have no personal agenda.

To my knowledge, no other township McHenry County can make that claim.

The purpose of the press release was to advise Grafton taxpayers they can look forward to four more years of accuracy and fairness (especially no deals).

It’s my firm belief that’s what the vast majority want (except those who long for the ‘ol days of “Let’s Make a Deal!).

e contrary, we’re using our past record as the minimum acceptable performance level for the next four years.” said Zielinski.

Above is from: http://mchenrycountyblog.com/2018/01/05/al-zielinski-staying-as-grafton-township-assessor/

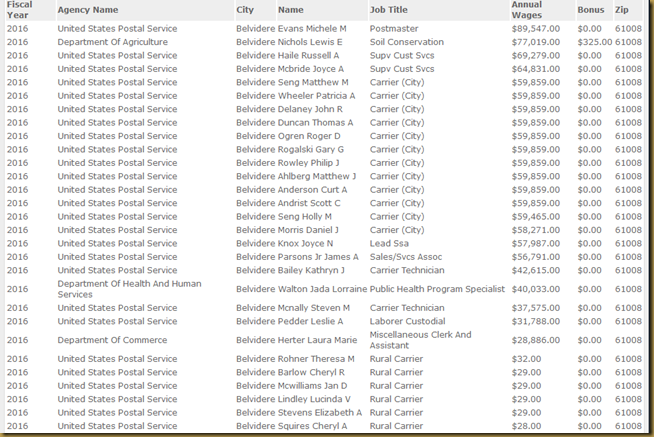

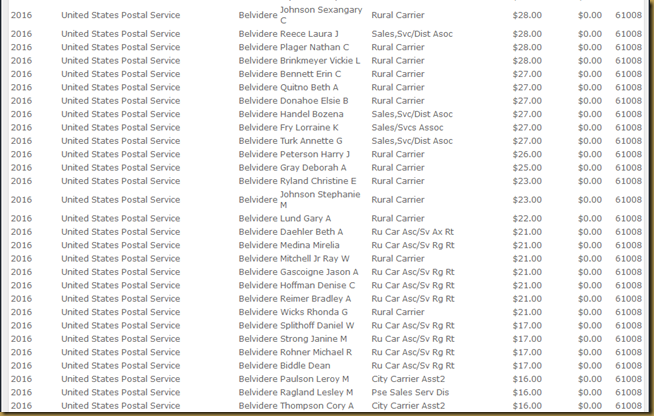

Below is the 2018 Fiscal Year budgeted salaries and benefit costs for the Supervisor of Assessment Office of Boone County.

Mr. Zielinski’s Boone County salary is $72,000 and benefits including health valued at an additional $22,338.