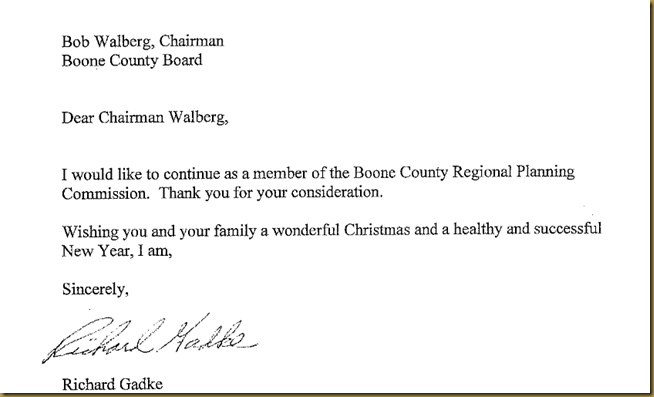

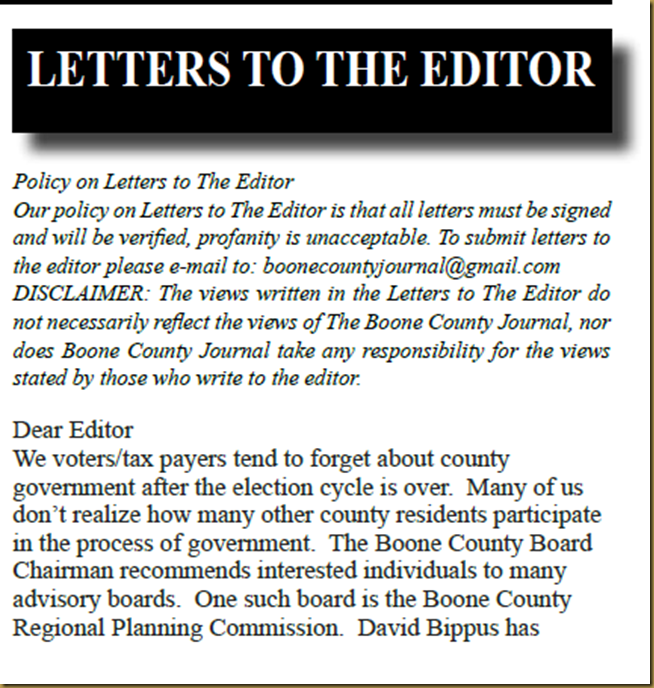

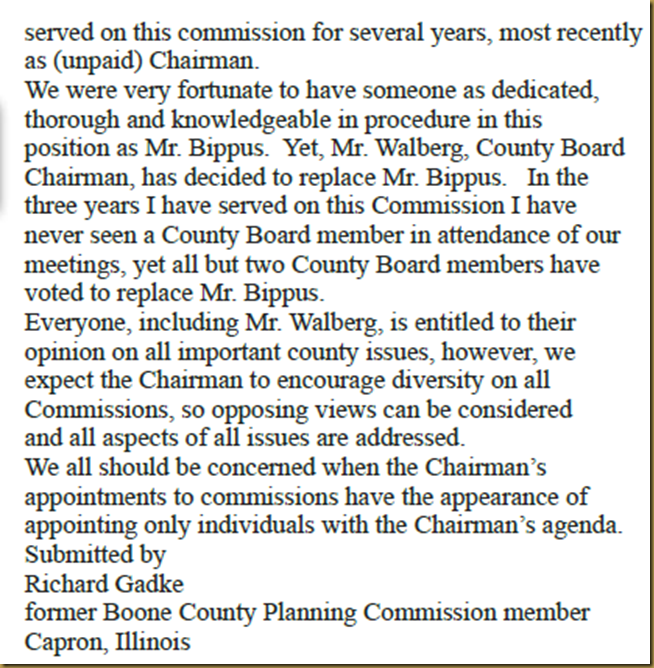

Because of questions regarding appointments--the resumes and letters requesting appointment were requested under the Freedom on Information Act. See the FOIA request and results below:

To

Ken Terrinoni

CC

Bob Walberg

Jan 26 at 3:58 PM

Chairman Walberg did not supply to the County Board all the resumes and application letters for the appointments approved on January 21, 2015. How can the board “advise” the chairman without this information. Mr. Walberg’s majority may blindly vote for his appointments but that does not mitigate board responsibilities. If in the future all applications are supplied to board perhaps they will comply with their advisory responsibilities.

If the board is not interested in the qualification of appointees I know the public may be.

Under the Freedom of Information Act please supply all application letters and resumes for all applicants to the appointments listed below:

Boone County Regional Planning Commission, Housing Authority of the County of Boone, Capron Cemetery Association, Capron Cemetery Association

This information may be posted on my inter net blog which is free of advertisement. This information has no commercial value to me.

BILL PYSSON

The following is the information received: