The Boone County Journal in the editorial on December 12, 2008 stated that --

“If 100 people outside the county courthouse were

asked how the building would be expanded to provide

more space, we doubt if anyone could state with accuracy

what will occur.”

Well I think we should make certain a few of us understand the county’s plan. Whether the plan is good or bad , I am indifferent. I just want to do what the county administration and elected officials don’t have time to do—explain what their plan is. First of all—they call their building program the 2020 Plan.

I am using the documents supplied to me by Mr. Terrinoni when I asked my representatives about the 2020 Plan. The latest update was in November 2008.

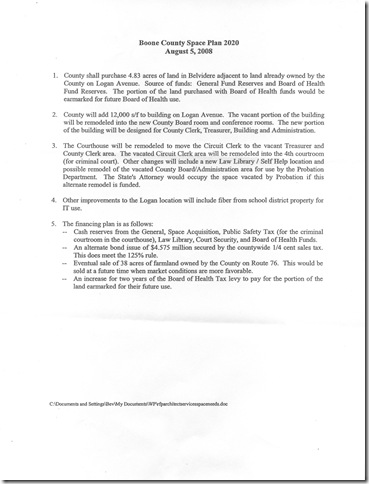

We need to understand what exactly is being built, remodeled and purchased. There are three major items on the 2020 plan: (a) purchase of approximately 5 acres next to the Logan Ave Building, (b) adding 12,100 square feet and remodeling 4000 square of office space at the Logan Ave Building and (c) remodeling the Courthouse for the circuit clerk, courts and probation. A thumbnail of the August 5, 2008 Space Plan is below. Please note the financing plans in item #5 changed and $4,995,000 was provided by bonds.

Click on it for a larger view.

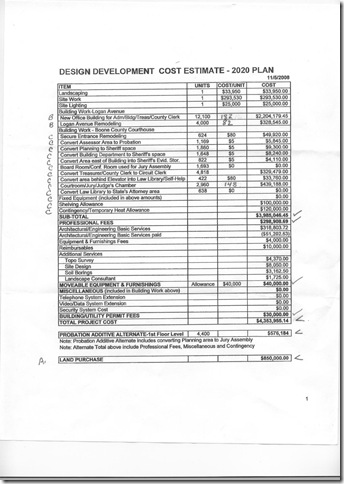

Below is the Design Development Cost Estimates for the 2020 Plan. Going first for the totals. $5,203,954 is the projected cost of the land purchase ($850,000), building construction costs ($3,985,046), profession fees ($298,909), building permits ($30,000) and furnishing allowance ($40,000). The profession fees are actually $51,203 higher because of previously paid architectural fees. There is a “Probation Additive Alternate” for $576,184 however that appears not be being pursued at this time.

It is difficult from the figures supplied to exactly split the cost at the Logan Ave facilities from the courthouse complex. Logan Ave probably will receive the bulk of the landscaping, site work and site lighting which total $352,480. The cost of the new space construction at Logan is $ $2,204,179 ($182 per square foot) and remodeled space $328,545 ($82 per square foot). Based upon construction costs and square footage 80% of the professional fees($239,000) appear to be due to Logan. Adding these figures to the $850,000 land cost, the total for Logan is just under $4 million ($3,974,204). From the figures supplied, 16,100 square foot of additional space will be provided. Thus the square footage cost for this space is $3,974,204/16100 or $246.85 per square foot. Granted the land maybe large enough for future expansion, nonetheless the figure appear very high to me; especially since 4000 square feet of the 16100 square foot project is remodeling.

With the exception of the County Board’s current conference room which is already used as a court room, nearly all of the old administrative offices have some cost associated with the court’s reuse of the facilities. An additional 16,654 square feet will be used for court related activities. There are no cost associated with 2331 square feet, $5 per square foot cost on 5499 square feet ($27,495), $80 per square foot cost on remodeling 624 square feet of the entrance ($49,920),$80 square foot cost relocation for law library ($33,760), $68.34 per square foot cost on converting 4,818 square feet in the old Treasurer’s and County Clerk’s offices to the Circuit Clerk’s Office($329,479), finally a courtroom/Jury and Judge’s chambers construction, $148 per square foot for 2960 square feet($439,188). I have estimated that 20% of the professional fees ($59,909) for the courthouse complex. The total building cost for the courthouse is estimated at $940,000, (actual figure is $939,751). The square footage cost of additional court space is $936,751/16,654, $56.43 per square foot.

Costs which I was unable to allocate to either building were $100,000 in shelving , $120,000 in contingent heating , $30,000 in permits (total: $250,000). Plus a $40,000 furnishing allowance.

Here are some additional handouts regarding the County’s big construction project. The first is the sequence of the events that will be occurring:

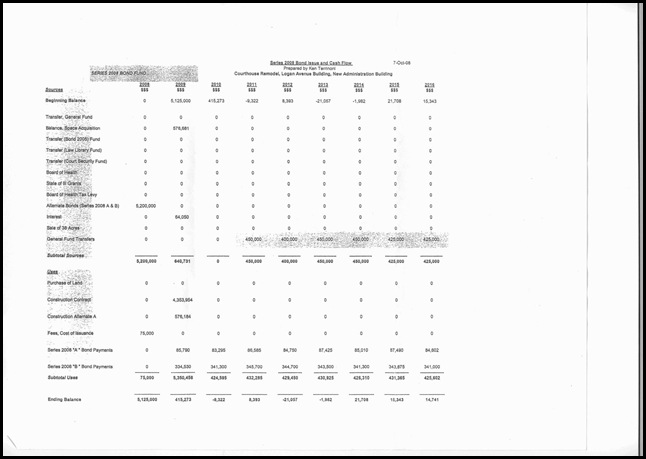

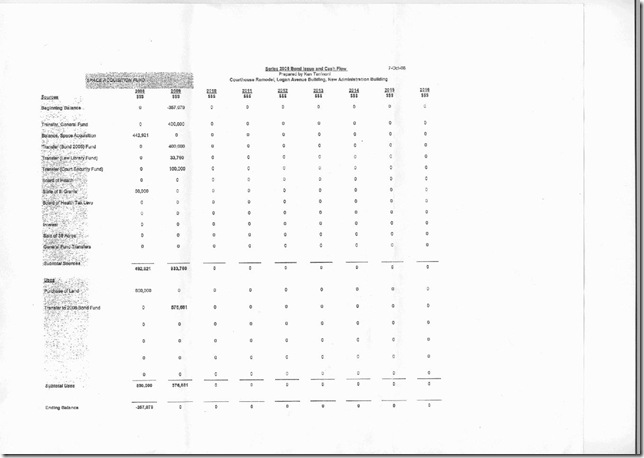

Next are some of the cash flow projections for repaying the bonds:

If we have questions, I think we ought to gather them together and ask that the county board provide us a formal response. If you have a question use either the comment section of the blog or email me at: boonecountywatchdog@gmail.com.