I just received a correction on this section--Boone County borrowed $5,200,000 ( before I stated just under $5,000,000) for the courthouse and administrative building remodel and construction. The county only netted $4,995,000 for the bonds; the rest paid for underwriting cost, primarily insurance on the bonds. Thus those cost were $205,000/$4,995,000 or 4.1%. That seems high perhaps someone else can comment. I am quite amazed because before the actual sale of bonds, the county administrator’s cash flow projections was using the entire $5,200,000 as the projected cash flow for the building project.

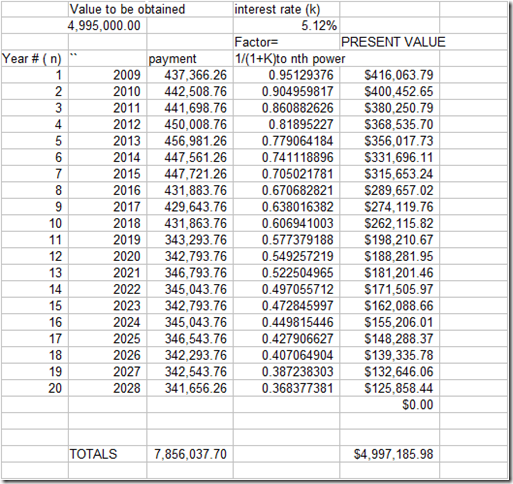

Using a present valuation of principle and interest payments, I calculated the effective interest as 5.12% because only $4,995,000 actual cash was received. If no insurance had been paid the rate would only have been 4.62%. The difference is 0.5 %. My calculations are below:

Repayment will be from the Quarter Cent sales taxes which the county receives. These funds also are a revenue source for the county’s general fund. If there is inadequate sales tax revenue, will the county board increase our county real estate taxes?

Here are some of the numbers which I currently have: First is the Quarter cent sales tax, note that it is running way below budget. It is short approximately $26,000 ; it is only 87% of the budgeted amount as of the end of October. Hopefully I can receive some updates in regard to the current months and see if there is any improvement.

As shown below the cash flow needs for the bonds is a little less than 50% of the total cash flow of the Quarter Cent tax. The total bond interest and principle due for FY 2009 is $437,366.26.

The Quarter Cent sales tax is not the only revenue source which is below budget. Is the county watching the numbers?

No comments:

Post a Comment