To the Boone County Board and Public

Did you know...?

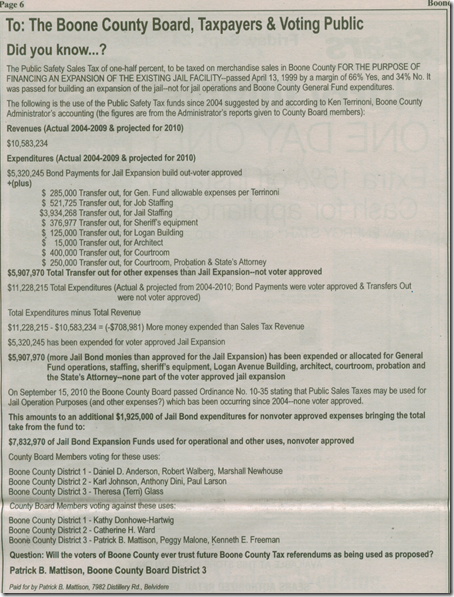

The Public Safety Sales Tax of one-half percent, to be taxed on merchandise sales in Boone County FOR THE PURPOSE OF FINANCING AN EXPANSION

OF THE EXISTING JAIL FACILITY--passed April 13, 1999 by a margin of 66%

Yes, and 34% No. It was passed for building an expansion of the jail--not for jail operations and Boone County General Fund expenditures.

The following is the use of the Public Safety Sales Tax funds since 2004 suggested by and according to Ken Terrinoni, Boone County Administrator's accounting:

Revenues (actual 2004-2009, projected 2010)

$10,583,234

Expenditures (actual 2004-2009, projected 2010)

$ 5,320,245 Bond Payments

+

$ 285,000 Transfer out, Gen. Fund allowable expenses

$ 521,725 Transfer out, Job staffing

$ 3,934,268 Transfer out, Jail staffing

$ 376,977 Transfer out, Sheriff's equipment

$ 125,000 Transfer out, Logan Building

$ 15,000 Transfer out, Architect

$ 400,000 Transfer out, Courtroom

$ 250,000 Transfer out, Courtroom, Probation, & States Attorney

$ 5,907,970 Total Transfers out

$11,228,215 Total Expenditures (Bond payments & Transfers out)

Total Expenditures minus Total Revenue

$11,228,215 - $10,583,234 = (-$704,981) More money expended then Sales Tax revenue

$5,320,245 has been expended for voter approved Jail Expansion

$5,907,970 (more than approved for the Jail Expansion) has been expended for General Fund operations, staffing, sheriff's equipment, Logan Avenue Building, Architect, Courtroom Probation, and the State's Attorney--none part of the voter approved Jail Expansion.

Question: Will the voters of Boone County trust future Boone County tax referendums as being used as proposed?

-- compiled and organized by Patrick B. Mattison, Boone County Board District 3