How does a $30 million loss go undetected?

Burke also addressed the issue of how such a large amount of money could go missing without anyone noticing. He stated that the city has an annual audit that is prepared by two independent certified public accounting firms. Neither of those firms disclosed any instances of non-compliance or other matters required to be reported under government auditing standards. Also, many of the city's accounts are held at Fifth Third Bank and the bank never reported anything suspicious. Since Dixon is a tax-capped community, cash flow problems became complicated due to the State of Illinois being substantially behind on income tax payments.

Click on the following for more details: Dixon mayor responds to comptroller arrest - WREX.com – Rockford’s News Leader

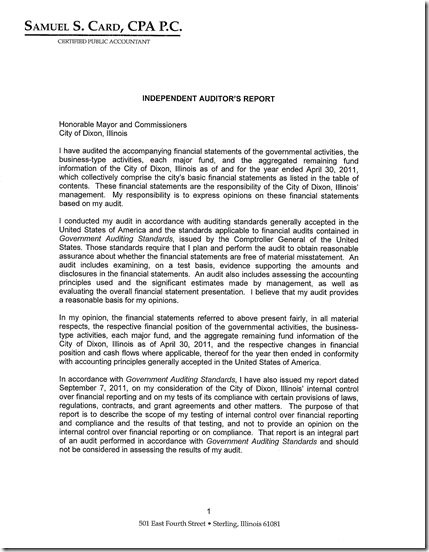

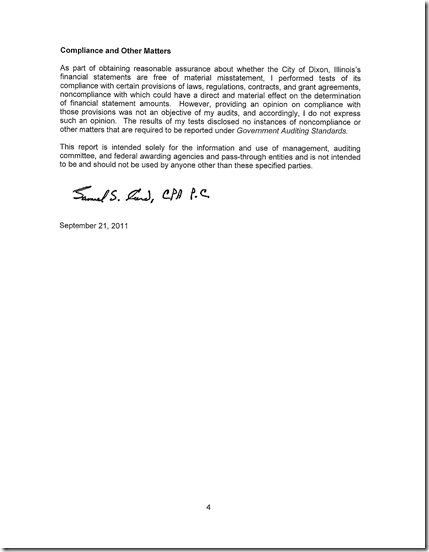

Below is CPA firm’s letter regarding Dixon’s 4-30-2011 audit. The entire CPA audit is available on the internet at: http://www.discoverdixon.org/cat_view/37-city-council-documents.html

Page 3 below states that CPA, Samuel Card,”did not identify any deficiencies in internal control…”

Click on the photocopy to enlarge:

Page 77

1 comment:

I don't believe CPAs consider finding fraud part of their audit duties.

Post a Comment