First of all, what this is not. This is not the $1,ooo,ooo (currently only $160,000) which the Treasurer/Tax Collector does not know to whom it belongs: [See: http://boonecountywatchdog.blogspot.com/2010/03/mr-treasurer-whose-1000000-is-it.html http://boonecountywatchdog.blogspot.com/2010/03/accounting-under-freedom-of-information.html ].

But rather this is the reserve account for Tax Sales Indemnity . Whenever a tax delinquent property is purchased the buyer is accessed a fee which is held in a reserve account. If the tax sale proves to be legally defective, the purchaser is compensated from the fund.

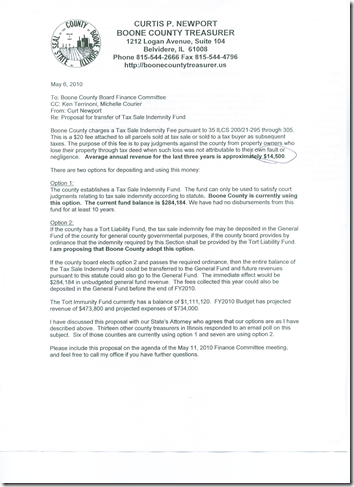

Tax sale purchasers pay on average of $14,500 each year into this account and there has been no disbursement from the account for ten years, so the reserve balance is $284,184. [See the photocopy below]

Since the 88th Illinois State Legislature (1993), counties which have Tort Liabilities Funds can pass a county ordinance and pay any claims for defective tax sales from the Tort Liability Account. After such an ordinance, both the reserve for Tax Sales Indemnity ($264,184) and future tax sales indemnity fees ($14,500 per year) can be used by the county’s general funds. It is quite amazing that Boone County would be unaware of the 1993 law change until now.

Well, county official are all ready to vote the ordinance. The money may even be already spent. Depending upon which side of the partisan divide has the votes, the quarter million may plug the budget deficit; pay for overages for construction at the courthouse/administration complexes; prevent lay-offs for the sheriff/jail; or used next year when the State gives the county even less funds?

Click on the photocopy to enlarge:

No comments:

Post a Comment