Elizabeth Campbell

January 15, 2016 — 10:27 AM CST Updated on January 15, 2016 — 3:55 PM CST

Chicago schools are borrowing to pay mounting debt bills and fund capital projects as the district’s liquidity deteriorates and its credit rating tumbles.

The Chicago Board of Education will sell $875 million of bonds on Jan. 27, according to Bloomberg data from J.P. Morgan, an underwriter on the deal. The deal is made up of $796 million of tax-exempt securities and $79 million of taxable debt, according to bond documents. The proceeds will cover capital projects, convert variable rate debt to fixed, fund swap termination payments and pay debt-service bills, bond documents show.

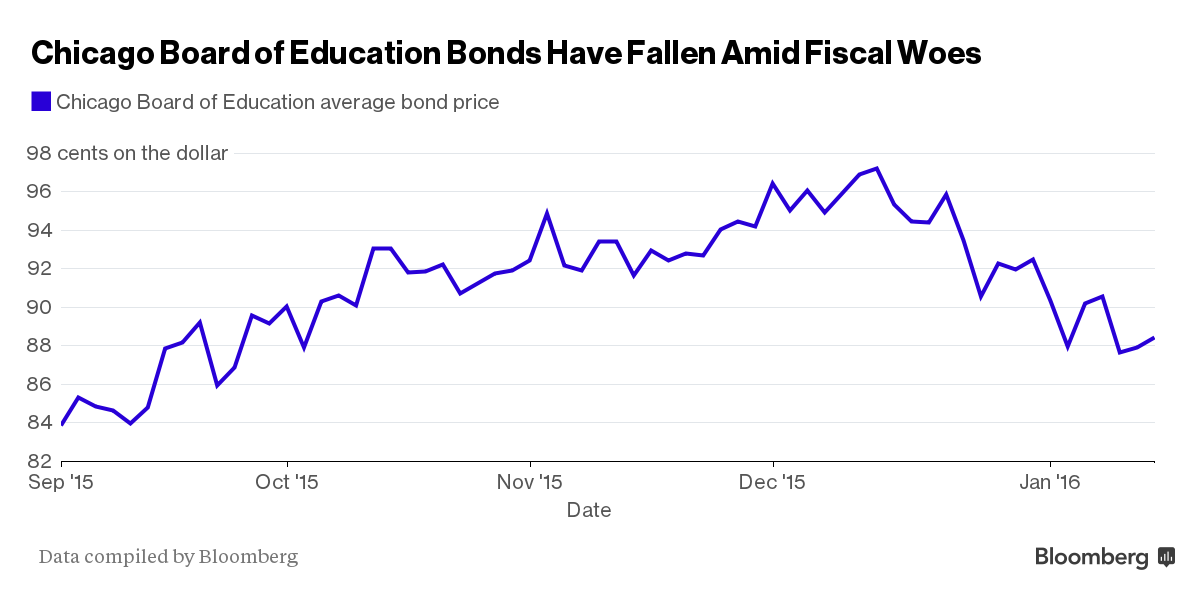

The most-actively traded school bonds, which mature in 2039, traded for an average of 88 cents the dollar on Friday to yield 6.5 percent. That’s down from 110 cents to yield 3.9 percent a year earlier, according to data complied by Bloomberg.

“Based in part on its limited ability to increase revenues and its increased expenses for pension and debt service, recurring operating budget deficits are projected to occur and could result in the reduction or elimination of essential educational services,” according to the bond documents.

The school district, the nation’s third-largest, has said it needs $480 million from the state of Illinois to close this year’s budget gap. Without the aid, the system faces deep spending cuts and more borrowing. Illinois Governor Bruce Rauner has said he won’t bail out the schools and will only help if officials like Mayor Rahm Emanuel support the structural changes that Rauner wants in the state. Rauner, the first Republican to lead Illinois in 12 years, is deadlocked with Democrats in the legislature over the state budget.

Rating Downgrade

“Chicago Public Schools is focused on resolving the district’s significant financial challenges, especially with upcoming streamlining to the bureaucracy and a teachers’ contract proposal that would prevent midyear layoffs,” Ron DeNard, the board’s senior vice president of finance, said in an e-mailed statement. “Long-term success is contingent on fair funding from the state of Illinois.”

Without action from the board or the state, the district’s operating deficit may reach $1 billion annually through fiscal year 2020, bond documents show. The board is considered junk by all three major rating companies. On Friday, Standard & Poor’s slashed its rating by two steps to B+, four levels below investment grade, and kept the district on CreditWatch with negative implications. That signals S&P may lower the rating in the next six months. The schools’ pension system is only 51.9 percent funded.

This “reflects our view of the board’s low liquidity and significant reliance on market access to continue supporting operating and debt-service expenses,” Jennifer Boyd, an S&P analyst, said a statement. “Adverse business, financial, or economic conditions will likely impair the board’s capacity or willingness to meet its financial commitments.”

Above is from: http://www.bloomberg.com/news/articles/2016-01-15/chicago-schools-wrecked-finances-on-display-before-borrowing

No comments:

Post a Comment