Take a look at Cal Skinner’s McHenry County Blog: http://mchenrycountyblog.com/2015/10/23/ten-townships-welfare-costs/#comments There is quite a discussion about the levy for general assistance, its administration and the large reserves. Some of our townships in Boone County may have similar situations.

Ten Townships’ Welfare Costs

Posted on 10/23/2015 by Cal SkinnerOctober 19, 2015

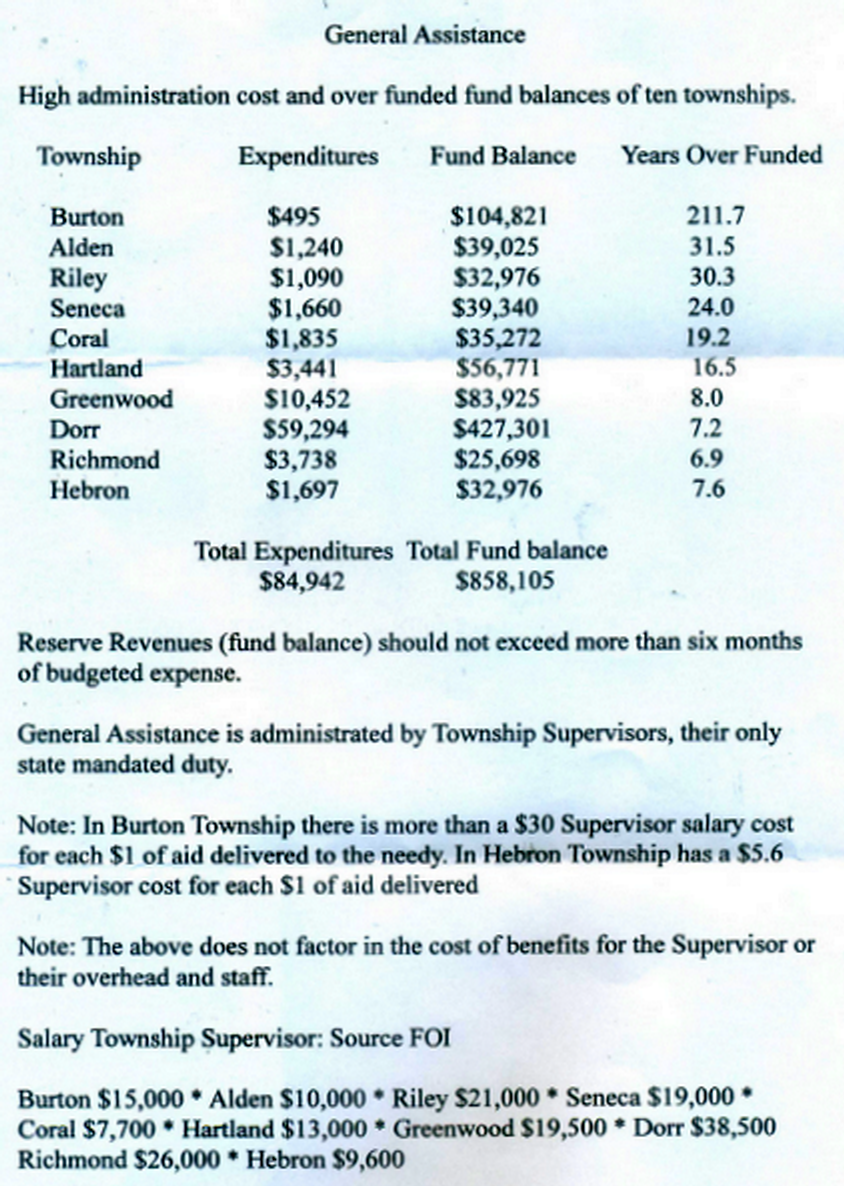

Found this comparison of Township General Assistant handed out and accompanying administrative costs.

Information about township General Assistance payments, fund balances and

You don’t have to guess that it came from Bob Anderson

Posted in Alden Township, Burton Township, Coral Township, Dorr Township, General Assistance, Greenwood Township, Hartland Township, Hebron Township, Richmond Township, Riley Township, Salary, Seneca Township, Township, Township Supervisor permalink

Post navigation

← Two More State Reps. React to “Retirement Tax”

A Former County Board Candidate Views on Valley Hi →

Comments

Ten Townships’ Welfare Costs — 19 Comments

-

Steve Reick on 10/23/2015 at 10:42 am said:

Since the number of people in need isn’t going down, this may be more due to the fact that people don’t realize that aid is available from the townships.

Attributing the Supervisor salary to just this one item, when townships have other functions that the Supervisor oversees is another straw man.

-

Crusher on 10/23/2015 at 11:27 am said:

Burton fund 211 years over funded, lol!!

and they raised taxes to build a building because they want what Richmond has.

wah wah wah!

-

The Nob on 10/23/2015 at 11:29 am said:

Where are the rest of the townships numbers?

Where are the comparative numbers to other welfare programs administered by other gov agencies like the county, state and fed?

Maybe a study should look into all the costs of the Supervisors office to see what percentage goes to what functions?

On the surface a adjustment in that area of Township gov is needed, but without more info, how do we know the facts?

Maybe it would benefit us all to have all welfare/assistance administered at the township level.

After all it’s easier to see the cheats locally than it is off in Woodstock, Springfield, or DC.

-

Honest Abe on 10/23/2015 at 11:43 am said:

The more businesses that are run out of Illinois due to oppressively

high taxes, regulations and government corruption, the more jobs those

employers will be taking with them.Leave now if you can, before Illinois becomes a Section 8 state and

you are stuck here paying for it. -

Charles Nelson on 10/23/2015 at 12:13 pm said:

The Supervisor’s salary must, by law, come out of the Town Fund.

The administrative expenses put through the General Assistance are usually offsets to pay for staff and office expenses of the Supervisor’s Office.

The General Assistance Fund is to provide assistance for those who do not qualify for other governmental assistance but have “demonstrable need”.

Emergency Assistance is for immediate and life or health emergencies.

The grant is limited to once every 366 days.

This is the most widespread scam in the state, as those who know the system milk it by designing emergencies, most likely, they stop paying utility bills for several months until they get a shut off notice (on or after the 366th day.)

The shut off notice is brought to the Supervisor, who then pays the bills up to the maximum grant.

This is widely known as the “13th monther program”.

My predecessor in Nunda Township had several acquaintance families on this when I took over (one family had done it for 13 straight years).

I ended it completely by requiring Workfare before any benefits were paid.

You should have seen how fast they hit the door going out.

-

inish on 10/23/2015 at 12:14 pm said:

There is NO demonstrated need for these funds.

There is no criteria for the awards other than the opinion of hte supervisor.

-

Charles Nelson on 10/23/2015 at 12:34 pm said:

Inish:

Unfortunately, you are close to right.

Mrs. Sherwood would give transients $25 gas vouchers just to get them out of the office.

-

rawdogger on 10/23/2015 at 1:45 pm said:

Conservative Republican head-scratcher:

Do we hate the Burton Township Supervisor for not doing his/her job or do we celebrate him/her for being a prudent guardian of taxpayer dollars?

Could be on par with the chicken-egg problem.

-

Charles Nelson on 10/23/2015 at 2:11 pm said:

To rephrase your question,

“Should we market free money to people who will take other people’s money just because the government will give it to them?”

Kudos to the Burton Township Supervisor for watching over the people’s money like he does his own.

Please remember, the Township Supervisor has other duties by law.

Steve Reich is correct; Bob Anderson does not always let the facts get in the way of his statements. We would never have heard of him if he had successfully bullied his Assessor into valuing his house at a fraction of its worth.

-

rawdogger on 10/23/2015 at 3:15 pm said:

The difference is that the Burton Township super still collects the same amount of tax dollars regardless of whether s/he spends them.

-

Grumpy grandpa on 10/24/2015 at 7:51 am said:

How foolish to take the whole salary and apply it to G A.but then it did come from the wonder lake barber who obviously is an expert on townships.

-

Watcher1940 on 10/24/2015 at 10:37 am said:

Let’s see…Steve who?thinks not enough people know to apply for this money…if they did, these excessive balances would be justified.

Nob wants some comparative studies because he’s always so open-minded when it comes to townships. (Lol)

Nelson denigrates Bob Anderson for making the numbers public…Anderson must have done it because he appealed his taxes, Sure makes sense to me!!!

I’m so glad this venue is available for all these intelligent comments. -

Preston Rea on 10/24/2015 at 12:45 pm said:

Townships must keep a surplus in General Assistance since there is no way to anticipate the demand in the coming year. One or two applicants that are qualified for health coverage can drain $30,000 from GA overnight. Since the Township is required by law to administer the program, the monies are required to be paid even if the GA fund is empty. One liver or kidney transplant, heart attack or other serious illness can destroy the finances of the Township.

-

Evert Evertsen on 10/24/2015 at 3:01 pm said:

How much time have the County GOP elected officials – committeemen / board members (S. Salgado, McCleary, R. Salgado, Anderson, Kurtz, Walkup, Gasser, Wheeler, Shorten, Skinner, plus others) spent on Township Consolidation? They still continue to spend time on this topic. A topic proven to increase property taxes. The initial proposal for Consolidation claimed a reduction of $40 million in property taxes over ten years.

How much time are those same people spending on the fight against school board property tax increases caused by increases in union contracts? None of the Townships in McHenry County are yet unionized.

How much time are they spending on fighting for the reduction of the Valley Hi TAX?

How much time are they spending on the elimination of the Conservation District Police force?

How much time are they spending on drawing attention to the ‘negotiated’ County Board contracts with the various Sheriff’s unions and other County employee unions? The County claims it is holding expenses level but how is this possible when the Board keeps approving salary increases? There are only two options:

1. Increase other sources of revenue

2. Reduce the number of employees

One method results in higher costs to residents and businesses while the other results in poorer protection by the Sheriff’s Department and reduced services in other departments.There are actions that can be taken locally to reduce property taxes (eg. Conservation District Police) but the changes required to reduce the cost of Township government MUST come from Springfield. We, the taxpayers can insist that County Board members cease and desist from approving wage increases for all County employees (union and non-union). Next year is an election year. Before you decide to support a County Board member, check to see how they voted on salary increases.

Springfield passed the law which does not permit a reduction of a Road Commissioner’s salary.

Springfield passed the law which requires Township Assessors to use a rolling three year average sale price of homes to assess properties but the COUNTY REVIEW BOARD can use current sales prices. This has created a phenomenal amount of work (and income) for County Attorneys who work on Property Tax Appeals.

Springfield passed the Prevailing wage laws which increase the cost of all Public sector work in Illinois.

The voters of the State of Illinois passed a new Constitution in 1970. The new Constitution and the continued overspending in Springfield by using tax dollars collected for pensions to support other government ‘handouts’ have resulted in the current standoff in Springfield.

This is Cal’s blog and he is kind enough to let us post our opinions here. However, I have had my fill of postings by Anderson and Walkup attempting to impose their agendas on the rest of us. We need to shakeup Springfield and quit wasting time on the Townships which accounted for 1.1 % of County Property tax and Road Districts which accounted for 2.11 % of 2014 County Property tax.

The County plus the Conservation District accounted for 12.09 % of 2014 Property taxes.

Public school districts accounted for 63.74 % of 2014 property taxes.

MCC alone accounted for 3.3 % of County 2014 property taxes which is more than all the Townships together. -

Watcher1940 on 10/24/2015 at 3:03 pm said:

I have no knowledge of what the law is pertaining to general assistance but if what Mr. Rhea says is true I think it would behoove the township supervisors to petition their state representatives to change that part of existing law. As with most aspects of township government there may have been a time this was a valid need but it should be no longer. It would be interesting to see the history of McHenry County general assistance applications and see how many times the public has used township funds for the extreme cases listed above. The ridiculousness of this premise, if valid, speaks to the reason we are being taxed out of our homes…that we should have to finance this type of extreme health emergency through township application. And if that is indeed the law, the existing balances should be multiplied many times to be sufficient.

-

Watcher1940 on 10/24/2015 at 3:27 pm said:

I see everetsen just wants the townships left alone…what else is new?????????????

-

Evert Evertsen on 10/24/2015 at 3:40 pm said:

With Townships being responsible for 3.21 % of all property tax in 2014, it is quite a stretch to state: “the reason we are being taxed out of our homes”

For the record, General Assistance taxes collected for the entire

County for 2014 totaled $543,650.31 which represents seven one hundredths of one percent.

Most of the time spent with applicants for General Assistance is spent on educating people as how to best use the services of the more than one hundred agencies involved in supporting the less fortunate in the County. How many of these agencies exercise the due diligence which Townships must by law? How many of these agencies verify legal presence in the U.S.A.? -

Evert Evertsen on 10/24/2015 at 3:41 pm said:

Don’t leave Townships alone, run for office and change what you do not agree with! I did.

-

Watcher1940 on 10/24/2015 at 3:54 pm said:

My error…”one of the reasons”. Are we supposed to congratulate you…if your ego needs it, congratulations

No comments:

Post a Comment