Well here is a tax bill from Stephenson County on one wind turbine somewhat smaller than the ones proposed for Northern Boone County. Assessments are done by the State of Illinois based upon megawatts so the Boone County assessment should be higher than $167,945.

Boone County’s total property assessment for 2014 is $978,051,132; see Table #2. Using a figure of $170,000 per wind turbine, fifty wind turbines would increase Boone County’s total property assessment by $8,500,000, less than a one per cent increase (.87%).

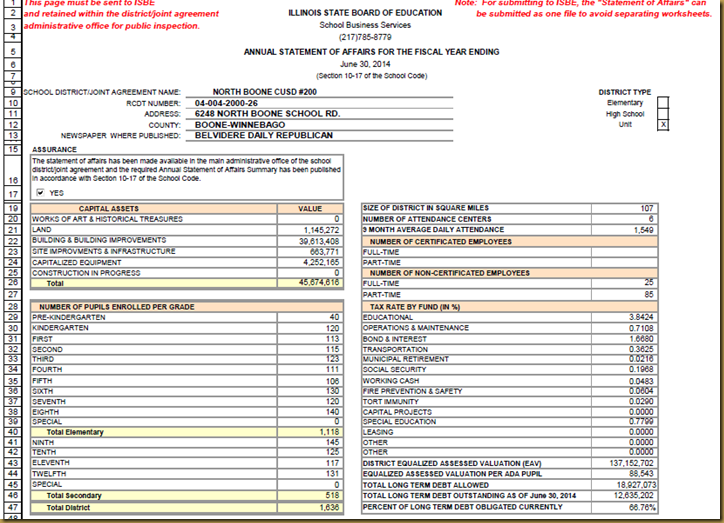

For the North Boone School District there would be a more dramatic effect. See Table #3, the District’s equalized assessed valuation (EAV) is $137,152,702. The additional $8,500,000 (fifty turbines) represents a 6.205% increase in assessed valuation.

In actual dollar terms, using the tax rates in Table #3—each year District #200 should receive an additional $514,394.50 for the various operating expenses and the taxpayers should receive $141,780 in assistance in paying the required principal and interest on outstanding school bonds.

Table #1 : Calculation of taxes to be paid to North Boone School District for a 50 Turbine Wind Farm with each turbine assessed at $170,000, $8,500,000 additional EAV.

Table #2

TABLE #3

Below is from: http://www.nbcusd.org/budgetinfo/FY14Annual%20Statement%20of%20Affairs.pdf

No comments:

Post a Comment