NEWS FLASH: This afternoon(8-23-2011) at 5:00 PM Belvidere Township Board will receive the environmental report on the old Eagle’s Club and will discuss further the purchase of the building for Y Activities. If you live in Belvidere Township please come.

Also remember the public forum regarding the new St. James Church—this evening at 6:30 PM at the Community Building—all parishioners and general public welcome.

Last week I posted Terri Glass’ request for financial information from Belvidere Township. [SEE: http://boonecountywatchdog.blogspot.com/2011/08/t-glass-freedom-of-information-act.html]

Another reader supplied this summary of township finances and its budget as proposed in April 2011.

First remember that basically there is a special accounting for each of the township accounts with each account having limitations as to allowable expenses.

The fiscal year is from April 1 to March 31. Here are the beginning and ending balances for the fiscal year ending March 31, 2011. Total fund balances increase by $505,612.22; the larges amount in the town account ($234589.71).

Click on the photocopy to enlarge:

TABLE 1

For the fiscal year ending March 31, 2012 the Belvidere Township is appropriating approximately $3.4 million. See the photocopy below. This is approximately the amount which taxpayers will pay to the township on their tax bills.

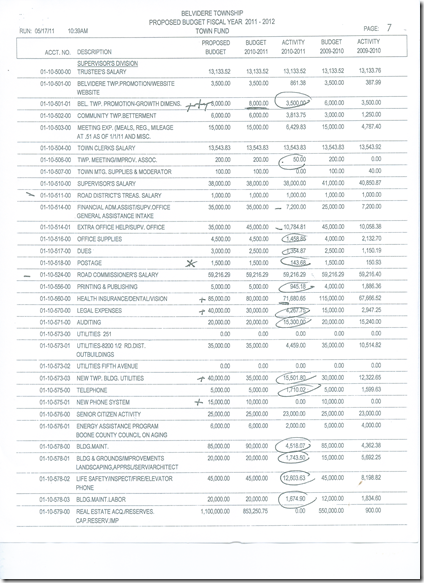

The following sheets supplies the 2012 budget/2011 budget and actual/2010 budget actual:

Town Fund Account 001

Detailed Town Fund

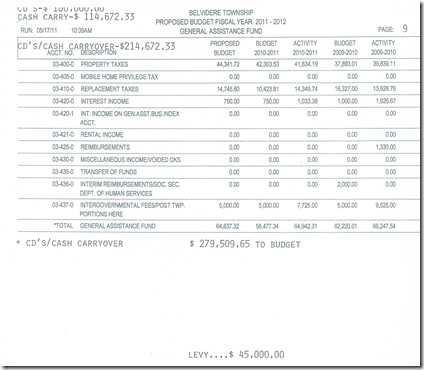

General Assistance Account 003 . Note the high CD’s/Cash Carryover from Table 1. During FY 2010 cash/CDE’s for General Assistance rose from $195k to $215.7k. The 215.7is 333.2 % of budgeted appropriation and a like number of budgeted expenditures. Should Belvidere township be levying any tax for general assistance when it has surplus equal to more than three years of actual expenditures?

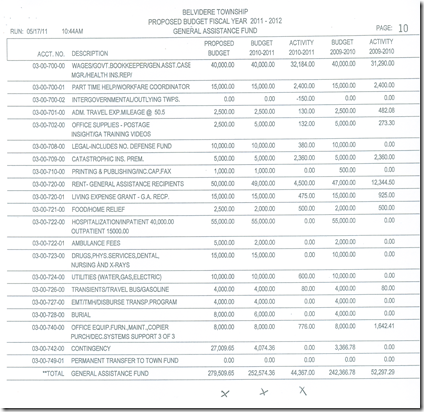

Approximately $65k is appropriated each year of which $45k is from property tax. Yet as shown by the detailed expenses, actual expenditures (Table 3) were only $42.3k in 2010 and $52.3k in 2009.

Look at the detailed actual expenses (Table 3). Administrative cost are almost all of the actual expenditures. In FY 2011 the only actual benefits for indigent were $4,500 rent; $600 Utility assistance, $475 living expenses , $500 food and home relief, and $80 transient travel. TOTAL: $6,165 In 201o $12,344.50 rent assistance, 925 living expense grant, $500 food/home relief, and $80 transient travel. TOTAL $13,849.20.

TABLE 2

TABLE 3

No comments:

Post a Comment