It took a special act of the state legislature in 1994 for the Community Building tax to begin. The real question is when will it ever end. Both the county and city codes have sunset provisions and annual reviews in them. But are any of the governmental units complying with these written requirements? Because of the county’s growth, the tax revenues have been high however it seems that the “needs” of the community building are constantly growing larger and the envisioned 10 year payoff will never occur.

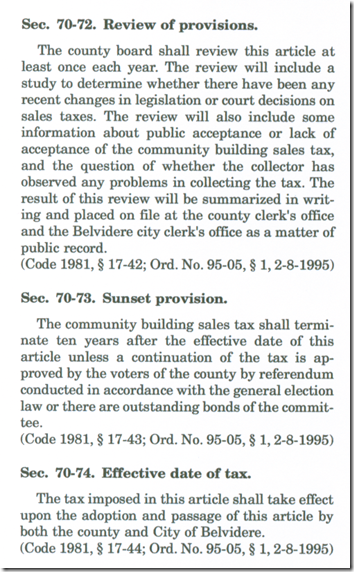

Here is what is stated in the county code:

Here are the nearly identical city code version:

Sec. 106-152. Review of provisions.

The city council shall review this article at least once each year. The review will include a study to determine whether there have been any recent changes in legislation or court decisions on sales taxes. The review will also include some information about public acceptance or lack of acceptance of the community building sales tax, and the question of whether the collector has observed any problems in collecting the tax. The results of this review will be summarized in writing and placed on file at the county clerk's office and the city clerk's office as a matter of public record.

(Ord. No. 934F, § 1(96.62), 2-6-95)

Sec. 106-153. Sunset provision.

The community building sales tax shall terminate ten years after the effective date of this article unless: (i) a continuation of the tax is approved by the voters of the county by referendum conducted in accordance with the general election law or (ii) there are outstanding bonds of the committee.

(Ord. No. 934F, § 1(96.63), 2-6-95)

When it comes to the annual review of the public acceptance and problems with collection, I question if this has occurred in a long time.

I use a Freedom of Information Act, requesting when the last time the county filed its required review with the county clerk. This is what I received back—the county treasurer’s tax report for the community building for the year ending 6-30-2009. Not what I expected or asked. Perhaps the FOIA really only requires that you send “something”. Perhaps the county and city has never completed the annual review.

Take a look and see if I could have asked the question any better? Will the county (or the city) ever abide by the review procedures? Will this tax ever sunset? Does the community building really need a full cent on all restaurant bills? There is a county election coming up—perhaps our county politicians should be asked a few questions about the community building.

Click on the photocopy to enlarge:

No comments:

Post a Comment