How is this possible? Where are the increases?

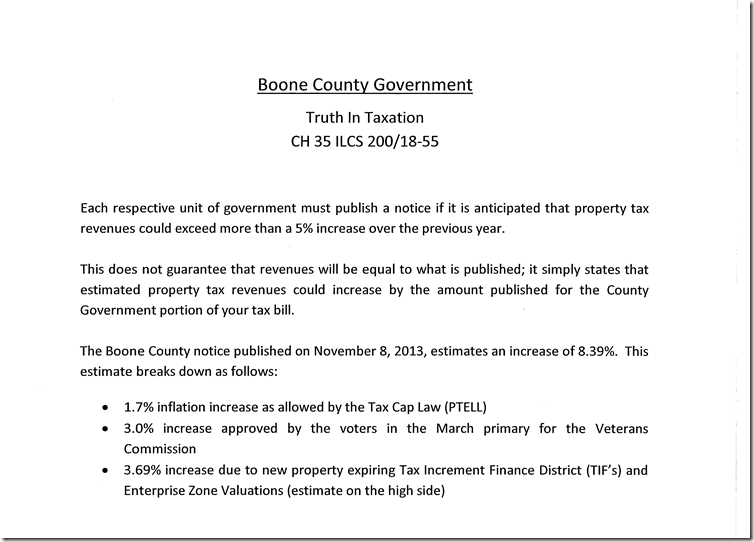

See the statement from the county’s website/Board Doc’s as shown below[https://www.boarddocs.com/il/boone/Board.nsf/files/9DLTUC790A23/$file/Truth%20in%20Taxation%20Hearing_201311191557.pdf] explains it quite well.

Only 1.7% is an increase in the current tax revenue over last year’s, 3% is because of the Veterans Assistance Commission referendum and 3.6% is for additional property on the the tax rolls.

Your personal increase in tax for the county should reflect the 1.7% PTELL increase and the 3% VAC. The additional 3.6% increase in property will not effect you unless your property was not on the tax rolls in prior years.

![[CPI+2008+Chart.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi8lBj9yn6-cnfSh5tTqxzLLKzfEeZBPBB5IdUvaVVEhPqPhYIDiv49evNORA9npabvju2Pz4S_p_euTR07B_nq34ypLGdiBptDygSXV0UKmKZA5scqLpOyrTe-c1ZwOxcsGbQMp95gt_I/s1600/CPI+2008+Chart.jpg)