Above is from the October 23, 2015 Boone County Journal which is available free of cost at merchants across the county and on-line at: http://www.boonecountyjournal.com/news/2015/Boone-County-News-10-23-15.pdf#page=1

Intended as a discussion group, the blog has evolved to be more of a reading list of current issues affecting our county, its government and people. All reasonable comments and submissions welcomed. Email us at: bill.pysson@gmail.com REMEMBER: To view our sister blog for education issues: www.district100watchdog.blogspot.com

Sunday, October 25, 2015

Thursday, April 10, 2014

Who Pays America’s Highest (and Lowest) Property Taxes? - Yahoo Homes

Who Pays America’s Highest (and Lowest) Property Taxes?

By Camille Salama April 9, 2014 12:31 PM

The second biggest cost of home ownership — following the mortgage — is usually property taxes. In 2012, U.S. homeowners paid an average of about $2,800 in property taxes, according to a recent Zillow study. And if you live in New York, New Jersey, or Colorado your taxes were in some cases five times more than the national average. The numbers are based on an average of real estate taxes paid on single family housing in 2012.

The residents of Westchester County in New York pay more in property taxes than the typical resident of any other major American county. The average property tax bill for a single family home in Westchester County comes to $14,829 a year.

Want to know how your county stacks up against the rest of the country? Check out our rankings below.

Adjusting for the average cost of single-family homes in each county, homeowners in Allegany County, NY win the award for the highest property tax burden. The average tax obligation of $2,549 in Allegany County amounts to 3.8 percent of the average single family home value; in Westchester County, the average tax obligation is slightly lower, at 2.5 percent of the county’s average home value. Nationally, the typical homeowner is spending approximately 1.4 percent of their home’s value on annual property taxes. See the full rankings below.

Highest Property Taxes as a Percent of Home Value

- Allegany County, NY (3.76%)

- Milwaukee County, WI (3.68%)

- Kendall County, IL (3.57%)

- Sullivan County, NY (3.56%)

- Orleans County, NY (3.49%)

Lowest Property Taxes as a Percent of Home Value

- Caroline County, VA (0.17%)

- Catahoula County, LA and Randolph AR (0.2%)

- Iberville County, LA and Cumberland County, TN (0.21%)

- Butler County, PA and Maui County, HI (0.22%)

- Elmore County, AL and De Soto County, LA (0.23%)

Who Pays America’s Highest (and Lowest) Property Taxes? - Yahoo Homes

Wednesday, November 27, 2013

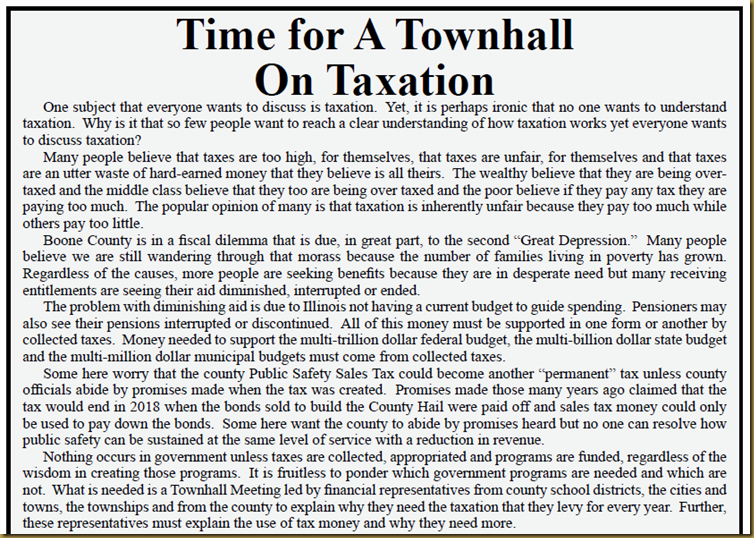

Mortgage less than taxes

The following house is for sale in the Capron area. 30 year fixed mortgage payment with 20% down is $319 per month. The taxes are $4,121.78 per year or $343.48 per month. See it at: http://www.homefinder.com/IL/Capron/155-Harvest-Moon-97678828d

Tuesday, November 26, 2013

The Belvidere Daily Republican Featured News

![[image%255B4%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhvGjWT-82ET9u4nLcK0hgtcoDSeq9CuBti2CxvHcCDNQZNzLRn1bIffzhvRZUgCfSkXrxdPAOlOjMzCl7IJB8f97MtlMV3NYLE-Rli5aLSsmpFUH0Wi5oHIVP1AhU7YaZ5spAR8bA6RexC/s1600/image%25255B4%25255D.png)

Sons of American Revolution induct new members

Nov. 24, 2013

ROCKFORD – The Kishwaukee Chapter of the Sons of the American Revolution (S.A.R.) held their annual meeting on Nov. 16 in Rockford.

The Chapter was honored to have the Illinois Society S.A. R. President, Bruce Talbot of Bolingbrook, Ill. present for the event, to conduct official ceremonies, and deliver the key-note address.

President Talbot inducted two new members, R. Nathan Bliss of Rockford, and Mark Kaletka of Batavia.

The primary purpose of the S.A. R. organization is declared to be patriotic, historical and educational. Membership is open to any man, at least 18 years of age, who is a lineal descendant of an ancestor who was loyal to, and rendered actual service, in the cause of American Independence during the Revolutionary War.

The Kishwaukee Chapter is headquartered in Belvidere, but includes several counties in north central and northwestern Illinois.

Boone County real estate transactions recorded Nov. 12

Nov. 24, 2013

BOONE COUNTY - Following is a list of the Boone County real estate transactions recorded during Nov. 12-15.

Recorded Nov. 12

1248 Candlewick Dr. NW, Poplar Grove, $245,000, Patrick C. Brady and Christine E. Brady to Robert Hayes and Kathryn Hayes.

7555 Garden Prairie Road, Garden Prairie, $550,000, LUSYD Acres, Inc. to 7555 Garden Prairie, LLC.

311 W. Perry St., Belvidere, $72,000, Louis R. Morrall, trustee, to Albert and Susan Williams.

12847 Prairie Meadow Way, Belvidere, $195,000, Andrew Dallas Hutchison to James T. and Evelyn A. Palek.

Recorded Nov. 13

1727 13th Ave., Belvidere, $60,100, Secretary of HUD to Jeannette Knutson.

114 King Henry Road SE, Poplar Grove, $90,500, Keith Kelly to James G. Origer and Mary C. Origer.

1132 Kishwaukee St., Belvidere, $81,851, Intercounty Judicial Sales to Secretary of HUD.

Recorded Nov. 14

302 Edson St., Poplar Grove, $130,500, Federal Home Loan Mortgage Corp. to Rodney L. Wilken.

2329 Malmaison, Belvidere, $315,000, Federal National Mortgage Assoc. to Sergio and Heather Velazquez.

418 W. Perry St., Belvidere, $65,000, Marion J. Downey to Amy L. Ortiz.

Recorded Nov. 15

17 King Henry SE, Poplar Grove, $90,837, Bank of America, NA to Bank of America NA.

157 Hastings Way SW, Poplar Grove, $77,400, Federal National Mortgage Assoc. to Leonardo Oliveira.

824 Allen St., Belvidere, $47,000, Derby Run LLC to Pedro H. Banuelos.

414 Wren Lane, Caledonia, $370,000, Kimberly Mackenroth and Danny Cessop to Harneet S. Bath and Komaljit Bath.

Hearings on property assessments to start Dec. 2

Nov. 24, 2013

BELVIDERE - The Boone County Board of Review will begin hearings on the 2013 appeals of property assessments on Dec. 2 at 9 a.m. Hearings will continue on Dec. 5-6 at 9 a.m., and if further hearings are necessary, more dates will be scheduled.

The Boone County Board of Review has the responsibility to hear complaints from property owners concerning the valuation of their property based on the market value or the use of the property.

Residential appeal forms are available in the County Assessor’s office, 1208 Logan Ave., Belvidere or online at http://www.boonecountyil.org/content/bor-residential-appeal-form.

Phone 815-544-2958 with any questions.

Capron Rescue seeks new station in Candlewick Lake area

Nov. 24, 2013

By Bob Balgemann

BOONE COUNTY - Capron Rescue Squad District has a new station on Poplar Grove Road and is renovating what used to be the main office in Capron.

Now officials are looking at the possibility of a third station, to help serve the southern end of the sprawling, 144-square-mile district. Sites in and around Candlewick Lake and the village of Timberlane are among the possibilities.

Owen Costanza, president of the district board of trustees, said that before he was appointed to the board there had been talk with Candlewick Lake officials about having a station in that area.

"They offered us space along (Illinois 76), but that was before my time," he said. "In my view, there's too much traffic around there."

Beyond that, he said Candlewick Lake owns property off Dawson Lake Road, on the south side of that community, which connects Caledonia Road and Route 76. "That would be a good place for a building," he said.

Just under 50 percent of the rescue squad's calls come from within Candlewick Lake.

The squad has money in its budget to explore locating a third station.

Costanza said he has asked Tony Stepansky, assistant chief of the squad, to renew that search.

Capron Rescue is transitioning to a paid on premises service, in an effort to improve response time. That means paramedics and EMTs, when on duty, must be at or in close proximity to the station. Before, they just had to be somewhere in the district.

Personnel since earlier this year have been able to spend all of their shift in the new station, a two-story, former farmhouse on the west side of Poplar Grove Road, just south of Quail Trap Road. Soon, they will be able to sleep over at the Capron station, too.

Stepansky said he is doing the due diligence on the search for a third station. "We're looking at 2014 to build or do something like we did in Poplar Grove," he said. "We want to be sure it's in the right place to do the most good."

Investment policy

POPLAR GROVE - There was a time several years ago when the village was $500,000 in the red. Now it is showing a surplus and officials are talking about the possibility of investing some or all of it.

There is disagreement as to whether that should happen.

Trustee Jeff Goings said at the October village board meeting that he thinks the two loans on the books at Poplar Grove State Bank should be paid off before any investing is done.

But village treasurer Maria Forrest said those loans are water and sewer debt, which would require the general fund to loan the money to the water and sewer fund to retire the bonds.

Still another view came from Trustee Bob Fry, who's also chairman of the village's finance committee. He thought the village could make more money by paying off the bonds than leaving the extra money sit in the bank.

He added that the village has worked hard to reach the point that it has six months worth of operating capital in the bank. That means it has enough money to run the town for six months if its revenue streams were severed. "A lot of municipalities have gotten into trouble because they didn't have any savings," he said.

While nothing definite was decided, Trustee Ron Quimby observed, "It all goes back to building blocks. This (issue) is part of the foundation."

Read the current Featured Stories by clicking on the following: rvpnews | Belvidere Daily Republican

Thursday, October 10, 2013

Township assessor’s office makes personnel changes | Belvidere Daily Republican

Anita Taylor, deputy assessor and certified appraiser, had resigned effective Sept. 27. She had been with the township for more than two years….

On Sept. 30, Helnore said she hired Jessica Muellner, a member of the Boone County Board of Review since 2009 to fill the vacancy.

“Jessica is well qualified and has strong credentials to do this job,” the assessor said. “Jessica accepted our offer and began working for the township on Oct. 1.”

Her job title is residential deputy assessor and she was sworn in Oct. 2 by Boone County Clerk Mary Steurer.

Sunday, July 7, 2013

Average Property Tax Rates and Homeowners’ Bills in McHenry County |

Will people continue to come to Boone County to escape the high taxes of McHenry County?

Well that may be very dependent upon where in McHenry they currently live.

Here are McHenry County’s rates:

Property tax rates in McHenry County ranked from highest to lowest. Calculated by Algonquin Township Assessor Bob Kunz. Click to enlarge.

The average tax for each community are as follows, keep in mind the higher McHenry County value of real estate makes the actual taxes higher than in Boone County.

Very interesting is the fact that lowest tax rate is for the community with the highest income—Barrington Hills—the village ranks 87th on the list of highest-income places in the United States (Wikipedia)

- Fox River Grove – $7,001

- Woodstock – $6,819

- McCullom Lake – $6,654

- Harvard – $6,469

- McHenry – $6,349

- Cary – $6,225

- Bull Valley – $6,130

- Marengo – $6,085

- Crystal Lake – $6,083

- Lakemoor – $6,081

- Island Lake – $6,026

- Holiday Hills – $6,009

- Richmond – $6,005

- Wonder Lake – $5,987

- Oakwood Hills – $5,937

- Trout Valley – $5,906

- Cary (unincorporated) – $5,906

- Hartland Township (unincorporated) – $5,903

- Lake in the Hills – $5,872

- Lakewood – $5,834

- Seneca Township (unincorporated) – $5,825

- Prairie Grove – $5,815

- Fox Lake – $5,779

- Port Barrington – $5,788

- Greenwood – $5,721

- Algonquin – $5,666

- Spring Grove – $5,551

- Huntley – $5,501

- Cary (unincorporated) – $5,458

- Riley Township (unincorporated) – $5,380

- Dunham Township (unincorporated)- $5,332

- Union – $5,310

- Algonquin Township (unincorporated) – $5,301

- Johnsburg – $5,223

- Hebron – $5,203

- Hebron Township (unincorporated) – $5,203

- Coral Township (unincorporated) – $5,401

- Ringwood – $5,035

- Alden Township (unincorporated) – $4,780

- Barrington Hills – $4,630

Saturday, June 15, 2013

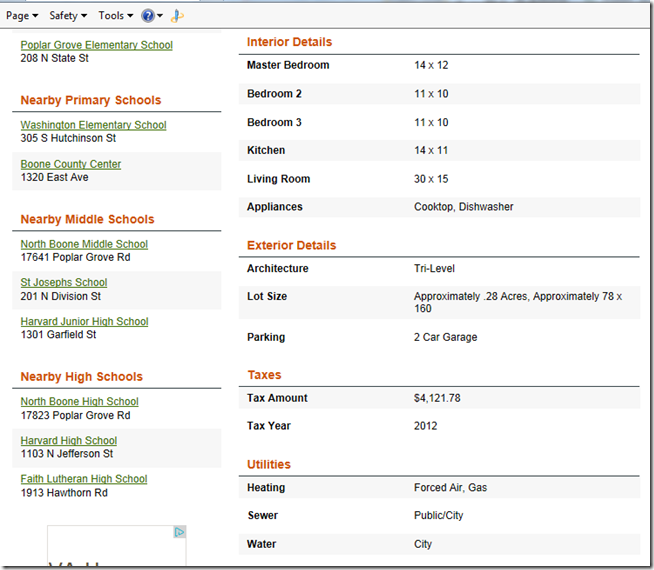

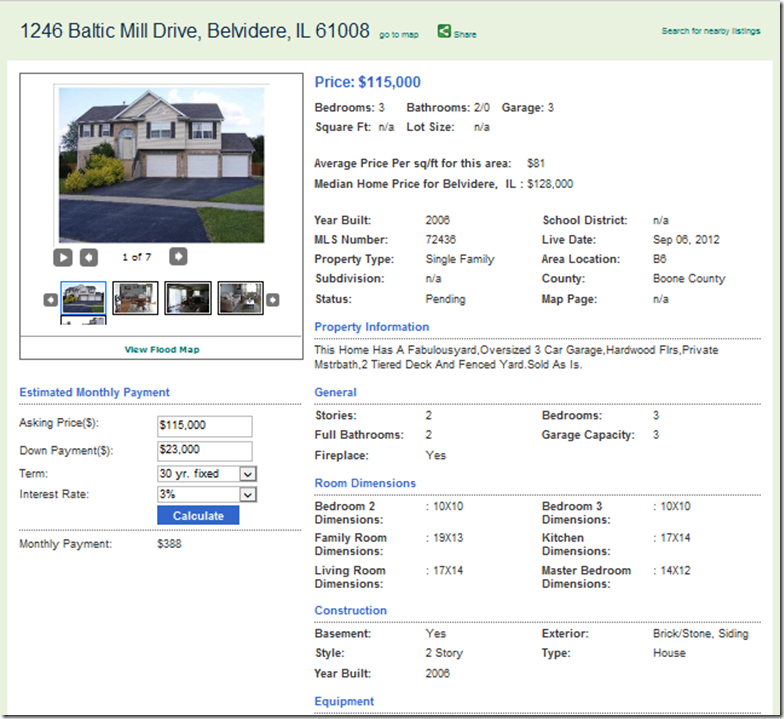

Real estate taxes greater than mortgage?

Well not quite, take a look at this house for sale in Belvidere. With a 20% down payment the monthly payment of $388 or 4656 per year is $12 more than the $4,644 in 2011 taxes.

This is currently available at: http://rockfordil.prustarckrealtors.info/details/start.aspx?PropId=169R000072436&vip=PruREfooter

Here is one that makes it. Monthly mortgage $257 or $3,084 per year taxes 2011 $3,396 or taxes $312 more than annual mortgage payment.

From: http://rockfordil.prustarckrealtors.info/details/start.aspx?PropId=169R201301066&vip=PruREfooter

Friday, February 3, 2012

America's Most Miserable Cities, 2012 - Yahoo! Real Estate

Scoreboard: 3 Michigan cities; 3 Florida cities; 2 Illinois cities; 1 each for California and Ohio

We looked at 10 factors for the 200 largest metro areas and divisions in the U.S. Some are serious, like violent crime, unemployment rates, foreclosures, taxes (income and property), home prices and political corruption. Other factors we included are less weighty, like commute times, weather and how the area’s pro sports teams did

10. Warren, MI The housing market collapsed in the Warren metro area, which includes Troy and Farmington Hills. The median home price is down 50% over the past three years, the second biggest drop in the U.S. after Detroit.

#9. Rockford, IL Property tax rates were fifth highest in the country in 2010. The median tax bill was $3,234 on home values of $136,000 for a rate of 2.4%.

8. Toledo, OH The city is ensnared in a scandal within its Department of Neighborhoods that involves alleged bid rigging and stolen funds. The FBI and U.S. Department of Housing and Urban Development are investigating the crimes. Toledo scores poorly when it comes to income and property tax rates.

7. Fort Lauderdale, FL The spring break mecca has been hit hard by the housing downturn. Median home prices in the metro division that includes Pompano Beach and Deerfield Beach are down 50% since 2006 to a recent $183,000.

6. Chicago, IL The Windy City is a cultural and financial center, but its residents must endure gridlock traffic, high property taxes and brutal winters. Commute times to work average 31 minutes, eighth worst in the U.S.

5. Sacramento, CA Sacramento’s lone pro sports team is flirting with a move to Anaheim unless the city delivers financing for a new arena. Sac-Town might not miss them. The team has lost 73% of its games since the start of the 2008-09 season. Foreclosures in California's capital were among the 10 highest last year.

4. West Palm Beach, FL South Florida has long been stained by corruption. One of the latest examples: Jose Rodriguez, the mayor of Boynton Beach (part of the West Palm metropolitan division) was suspended from his office last month by Gov. Rick Scott after he was arrested for allegedly using his position to obstruct a child abuse probe involving his wife's estranged daughter. Home prices in the West Palm area are off 50% since 2006.

3. Flint, MI Flint razed 775 abandoned homes in the year ending October 2011, to try and change the city landscape. The state of Michigan appointed an emergency manager last year to take over Flint's budget and operations. Crime remains a severe problem with the violent crime rate the third worst in the U.S.

2. Detroit, MI Detroit has closed schools and laid off police in an effort to avoid a bankruptcy filing this year. Home prices are down 54% the past three years, worst in the U.S. The median price was $38,000 last year in the Detroit-Livonia-Dearborn metro division.

1. Miami, FL The housing crisis has devastated Miami with 47% of homeowners sitting on underwater mortgages. Foreclosures have been rampant with 364,000 properties in the Miami area entering the foreclosure process since 2008 according to RealtyTrac.

.

Click on following for the details: America's Most Miserable Cities, 2012 - Yahoo! Real Estate

Thursday, September 22, 2011

Kane County taxpayers say assessments too low

board members told Armstrong many of the complaints are coming from people looking to sell their homes at a price point that now is not supported by the new property assessments they’re seeing.

“Well, if they don’t believe they are paying their fair share of taxes and want to pay more, then they certainly have the right to file an appeal,” a dumbfounded Armstrong said.

Read more: http://www.dailyherald.com/article/20110922/news/709229734/#ixzz1Yk6SOIrc

Sunday, September 11, 2011

“Belvidere May have too many schools in five years”

To read the entire article go to: http://www.rrstar.com/insight/alexgary/x219198780/In-Sundays-paper-Suburbs-absorb-exodus-from-Rockford

Neighboring ZIP codes absorb Rockford exodus

The latest release of 2010 census data proves what anyone driving around the Rock River Valley already knows — the population is moving.

The U.S. Census Bureau released population changes from 2000 to 2010 broken down by ZIP code. In Winnebago County, just two major ZIP codes lost population. Downtown Rockford east of the river, 61104, fell by nearly 6 percent. And 61101, which is Rockford’s northwest side, declined by 8.1 percent. And of those Rockford ZIP codes that did see population growth, not one saw even 10 percent growth.

For much of the decade, the moving vans were heading to such places as Poplar Grove and Belvidere, where populations grew by 35.8 and 17.3 percent, respectively, and Winnebago, up 20.4 percent.

…..

Both the Belvidere and North Boone school districts in Boone County felt the crunch of new families flocking to their areas. Belvidere built a new middle school and a second high school. North Boone expanded an elementary school, built a new high school and put on an addition to the old high school.

Michael Houselog was superintendent of North Boone for much of the decade and now is the superintendent of Belvidere. In the 2000-01 school year, Belvidere had 6,352 students and North Boone 1,283. By 2007, Belvidere’s student population surged to 8,728 and North Boone’s to 1,686.

But in the wake of the Great Recession, the growth rate has slowed. In 2010, Belvidere was up to 9,001 and North Boone to 1,746.

And Houselog said that unless the economy revives and people begin returning to Boone County, Belvidere is going to have too many schools within five years.

“This year, our three smallest grades are kindergarten, first and second grade,” Houselog said. “This will put it in into context. In 2005, we had more than 700 kids in kindergarten. This year we have 485.”

Still, Houselog is confident that Boone County will become a destination of choice again.

“The things that made this a desirable place haven’t changed. We have lower tax rates than what you’ll find in the Chicago area. Having (Interstate 90) coming through our county allows easy access to Rockford, Madison, Chicago,” he said. “When the economy turns, we think it’ll turn here first. The question is when.”

While the once hot growth areas wait for another boom, Krause said the aging areas of Rockford are waiting on something else — reinvestment.

“In Chicago, there are a number of aging neighborhoods that have done well because developers took industrial buildings and turned them into condos,” Krause said. “Part of the reason they took that risk is because prices in Chicago’s suburbs had increased so much that it made sense to reinvest in the older neighborhoods. That could happen here, but so many developers were hurt by the recession that few are ready to take that risk in Rockford.”

Krause said there have been some residential redevelopment success stories in Rockford, such as the Brown building downtown and the Garrison Lofts & Town Homes, but much more is needed to persuade retailers to come back as well.

Assistant Business Editor Alex Gary may be reached at agary@rrstar.com or at 815-987-1339 begin_of_the_skype_highlighting 815-987-1339 end_of_the_skype_highlighting.

Copyright 2011 Rockford Register Star. Some rights reserved

Monday, April 4, 2011

Changes in Assessments in McHenry County

The following is from Cal Skinner’s Blog: http://mchenrycountyblog.com/2011/04/04/real-estate-tax-assessments-down-9/

McHenry County as a whole had a 9.6% decrease in assessments. Many of the townships bordering Boone County has very large degreases: Chemung—(13.1%); Dunham—(8.6%); Marengo—(10.3%) and Riley—(7.5%). All of this reinforces a large decrease in Boone County.

McHenry County Townships.

Wednesday, January 12, 2011

Clout St: Quinn congratulates Democrats on income tax increase

The Tribune supplies a good summary of the new tax bill as well as the actions taken to pass the bill.

The tax increases, which would take effect retroactively to Jan. 1, would raise an estimated $6.5 billion over a full-year period.

In addition, the measure would attempt to limit spending in each of the next four budget years — $36.8 billion in the 2012 budget year, $37.5 billion in 2013, $38.3 billion in 2014 and $39 billion in 2015. The state’s auditor general would determine if lawmakers and the governor exceed those spending limits. If the limits are exceeded, the higher income tax rates would revert to current levels

Click on the following for more details: Clout St: Quinn congratulates Democrats on income tax increase

Wednesday, October 27, 2010

Latest Boone County assessed values published in Belvidere Daily Republican

2010 Boone County assessment appears in the Tuesday, Oct. 26 Belvidere Daily Republican.

The publication list is made up of the changes in assessments made by the Boone County Township Assessors

The Illinois Property Tax Code requires the assessed value to be determined on the three previous years of sales compared to the three previous years of assessments. The assessment cannot drop as quickly as the market currently indicates.

According to the Illinois Department of Revenue for 2010, the assessed value of residential, including farm residential, commercial and industrial property in Boone County had to be reduced by just over 7 percent based on the 3 previous years of sales compared to assessed values to be at 33.33 percent of value

Wednesday, October 20, 2010

McHenry County Sells More Than 3,000 Delinquent Taxes

About 70 people from as far away as Florida were buying the right to pay McHenry County residents' real estate taxes in return for payment plus interest at some point later on

bid-down" one, the winner of each certificate being the person willing to accept the lowest rate of interest. That was pretty low this year and some bidders dropped out in disgust. One part-time investor over from Savannah said, "Two or three percent, that's not enough to make all the research and risk worth the trouble."

Click on the following for more details:

FirstElectricNewspaper: McHenry County Sells More Than 3,000 Delinquent Taxes

Thursday, August 19, 2010

Bill proposed to close property-tax loophole | News-Gazette.com

Illinois House Bill 6241 that should eliminate the confusion.

The bill creates the Manufactured Home Installation Act, which requires a manufactured home that's installed on private property and not located in a mobile home park, to be assessed and taxed as real property. And mobile homes located inside mobile home parks will continue to be taxed according to the Mobile Home Local Services Tax Act. But mobile, or manufactured, homes that are located outside mobile-home parks and not classified, assessed and taxed as real property prior to the new law taking effect will remain that way unless the home is sold, transferred or relocated.

Click on the following for more details: Bill proposed to close property-tax loophole | News-Gazette.com

Tuesday, April 13, 2010

Look for McHenry Co. tax rates to rise as property values decline

Take a look at the community college increases—McHenry County College is up only 2% but Harper and Elgin CC are up 20%

….economy that continues to hammer the housing industry. But another factor appears to be a growing number of property owners challenging their assessments and, far more often than not, winning. Last year, the county's Board of Review heard a record 4,328 challenges and, Mayberry estimates, about 90 percent of them succeeded.

By levying the same or more, the taxing bodies force the county clerk to set a higher tax rate, allowing them to come up with the chosen amount amid declining assessed valuations.

Daily Herald | Look for McHenry Co. tax rates to rise as property values decline

Friday, February 19, 2010

Chrysler buys Sterling Heights plant for use until 2012 Detroit Free Press

Several empty Chrysler plants without equipment were sold at this price.

Sterling Heights Assembly is a Chrysler automobile factory in Sterling Heights, Michigan. The factory opened in 1953 to produce missiles. Volkswagen converted it for automobile production in 1980 and it was subsequently purchased by Chrysler in 1983. The nearby Sterling Stamping opened in 1965. As the plant was modernized in 2006, the old Stratus assembly line and tooling was sold to OAO GAZ and had been shipped to that company's factory in Nizhny Novgorod in Russia. GAZ continues to produce the Stratus under license there.[1][Wikipedia]

On May 6, 2009 it was announced that the Sterling Heights Assembly plant will close by December 2010.[2] However, the adjacent stamping plant will remain open.

Chrysler is getting a bargain at $20 million, especially considering that the city of Sterling Heights has offered to extend $7.4 million in property tax abatements.

plant, which Chrysler bought from Volkswagen in 1983, is one of Chrysler’s oldest assembly plants. Its paint shop likely would have to be upgraded or replaced if Chrysler would assign it a new product after 2012

Click on the following for more details: Chrysler buys Sterling Heights plant for use until 2012 | freep.com | Detroit Free Press

Thursday, December 10, 2009

West Dundee to see higher burden in taxes

property tax levy would be a 14 percent increase over the previous total of $2.6 million, and would cost the average homeowner an additional $833 per year

Sales tax revenues are projected to be $2.2 million for the year, which is down 13 percent from last year and 26 percent from two years ago.

Even with the increased tax levy and additional taxes, West Dundee's municipal tax rate remains the second lowest in the area; only Sleepy Hollow's is lower.

West Dundee to see higher burden in taxes :: The Courier News :: Local News

Wednesday, December 2, 2009

Australians-have-the-worlds-biggest-home

Australia has overtaken the United States, the heartland of the McMansion, to boast the world's largest homes, according to a report by the Commonwealth Bank of Australia.

Click on the following for more details: study-australians-have-the-worlds-biggest-homes: Personal Finance News from Yahoo! Finance

Monday, November 23, 2009

Property-tax-less towns not ready to follow Schaumburg's lead

From Carol Stream to Oak Brook, to Gurnee, Vernon Hills, Campton Hills and Lily Lake, officials are facing the challenge of sustaining services as revenues drop, but so far have been able to weather the current economic storm without resorting to the property tax.

Click on the following for more details: Daily Herald | Property-tax-less towns not ready to follow Schaumburg's lead