Market reactions to past virus scares show stocks may have more to lose

PUBLISHED TUE, JAN 28 202012:38 PM ESTUPDATED AN HOUR AGO

KEY POINTS

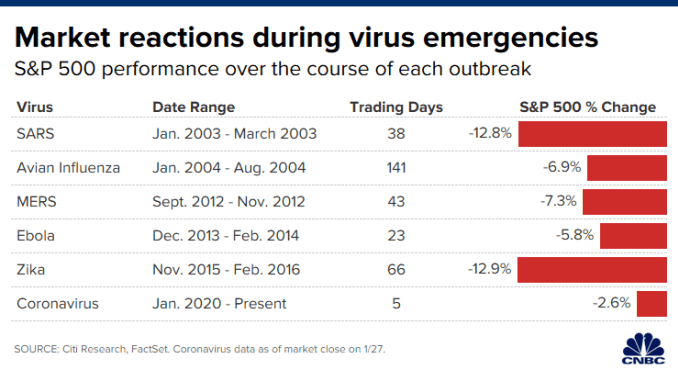

- Looking back 20 years, previous epidemics from SARS in 2003 to the Ebola scare six years ago shaved 6% to 13% off the S&P 500 over different lengths of time, according to Citi.

- The equity benchmark was down about 2.6% through Monday’s close since Jan. 21.

- Zika started in Nov. 2015 and was spread mostly by bites from infected mosquitoes. The market suffered a near 13% pullback in the span of 66 sessions.

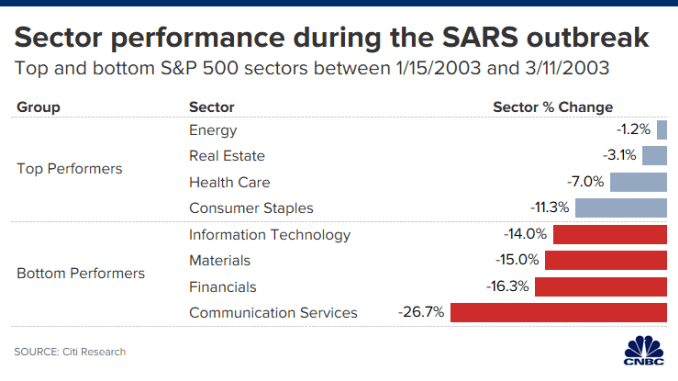

- All 11 S&P 500 sectors declined during SARS, and information technology and communication services were among the biggest losers, falling 14% and 26% respectively.

A trader works on the floor of the New York Stock Exchange.

Getty Images

Investor anxiety over the coronavirus led to the Dow Jones Industrial Average’s longest losing streak since August, and the market may have more to lose, going by past epidemics.

Looking back 20 years, previous epidemics from SARS in 2003 to the Ebola scare six years ago shaved 6% to 13% off the S&P 500 over different lengths of time, according to Citi’s head of U.S. equity strategy Tobias Levkovich. The equity benchmark was down about 2.6% through Monday’s close since Jan. 21.

The coronavirus outbreak has killed 106 people and infected 4,515 in China, and the disease has spread to countries around the globe. Medical experts have compared the coronavirus to the severe acute respiratory syndrome, or SARS, which lasted 38 trading days and resulted in a 12.8% sell-off in the S&P 500.

The most recent outbreak was Zika, which started in Nov. 2015 and spread mostly by bites from infected mosquitoes. The market suffered a near 13% pullback in the span of 66 sessions.

“The SARS scare in Hong Kong in 2003 changed the mindset of fund managers who had not dealt with such a health risk emergence and therefore MERS, Ebola, Zika, avian flu, and now coronavirus has created deep concern with still limited information on the extent of contagion and what remedies can be put in place and over what timeframe,” Levkovich said in a note.

Tech biggest loser

All 11 S&P 500 sectors declined during the SARS outbreak 17 years ago, and information technology and communication services were among the biggest losers during the period, falling 14% and 26%, respectively, according to Citi’s analysis.

That’s because China has been an important manufacturer and supplier for many American tech companies. Apple, for example, could see its iPhone production slowing down due to the coronavirus outbreak, the Nikkei Asian Review reported Tuesday.

“Pure China exposure stocks tend to be more IT oriented due to supply chain dynamics and it is likely that shipments from places other than Hubei province probably continue with moderate disruption, but time will tell,” Levkovich said.

Financials were the second-worst performer during SARS, declining 16% as falling bond yields posed a profit threat to banks.

To be sure, while history may suggest the sell-off could continue, the economy is in a better place today with a resilient consumer base and strong business spending, which could prevent a bigger market pullback and a negative economic impact.

“The U.S. economy and market is much more domestically-focused,” Levkovich said. “We do not envision a major domestic slowdown as a result of the China news, but this does not mean that share prices cannot continue to falter in the nearer term.”

— CNBC’s Nate Rattner contributed to this report.