The Sheriff is requesting Boone County Board to purchase eight new squad cars for approximately $18,500 each. The funds are to be obtained from the PSB Bond fund. This would be over and above the $200,000 limit imposed by Ordinance 10-35 for FY 2015. See Ordinance below.

Here are some of the facts regarding the issue whether this sales tax should be used for anything other than interest and principle on the PSB Building.

This was previously posted in 2012.

Boone County’s half cent sales tax for the Jail

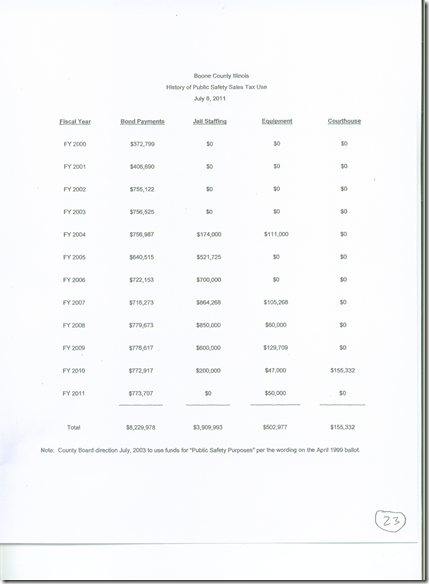

Boone County Government’s website has a summary of the history of this sales tax. The following are excerpts from that site which is at: http://www.boonecountyil.org/sites/default/files/pubsafety%20sales%20tax.pdf

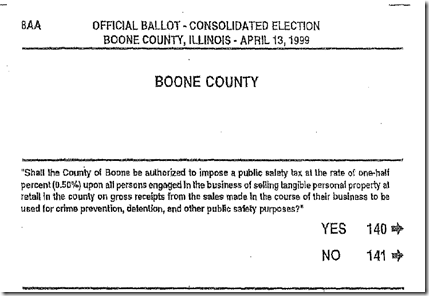

First, the actual ballot resolution

Click on the photocopy to enlarge:

The Boone County Board’s 1999 published statement regarding the referendum issue.

Beginning in FY 2004 (12-1-2003 to 11-30-2004) the county began using the sales tax for items related to jail operations but not related to bond repayment. Note the FY 2001 numbers were only for part of the year. See below:

For FY 2011, a very large use of Jail sales tax was actually authorized. See Ordinance 10-35 below. The county proposed very large operational expenses for the sales tax, gradually reducing it until it was projected to stop in 2018 with the final payment on the jail bonds.

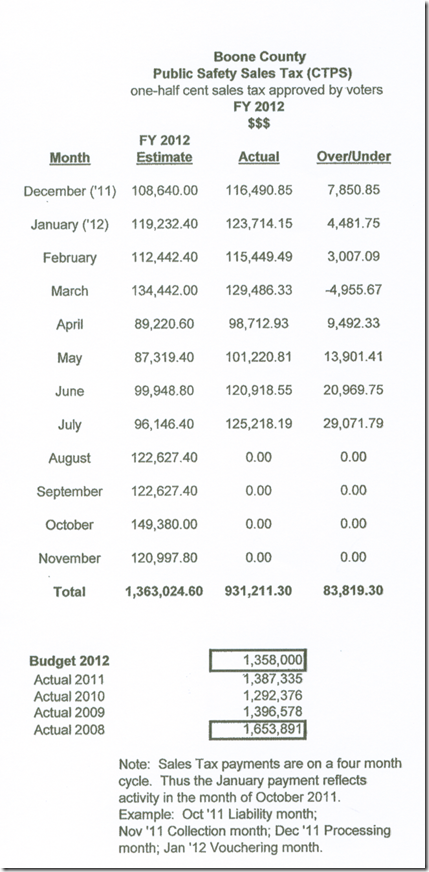

The half cent PSB sales tax was budgeted to be $1,358,000 for the FY 2012. The highest PSB tax receipts was in 2008 when $1,653,891 was received. See below: