Read Full Report

The 2015 Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States (the fifth edition of the report) assesses the fairness of state and local tax systems by measuring the state and local taxes that will be paid in 2015 by different income groups as a share of their incomes.1 The report examines every state and the District of Columbia. It discusses important features of each state’s tax system and includes detailed state-by-state profiles that provide essential baseline data to help lawmakers understand the effect tax reform proposals will have on constituents at all income levels.

The report includes these main findings:

• Virtually every state tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from wealthy families. The absence of a graduated personal income tax and overreliance on consumption taxes exacerbate this problem.

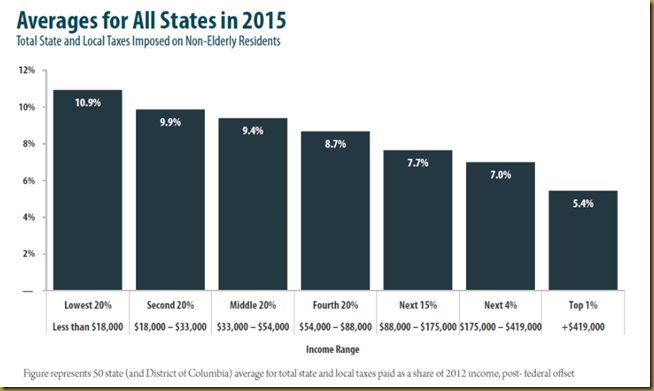

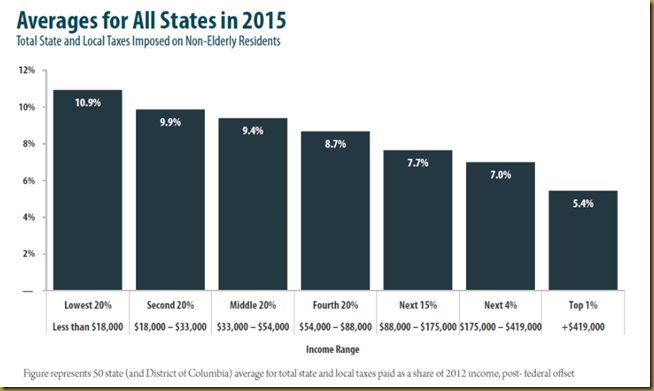

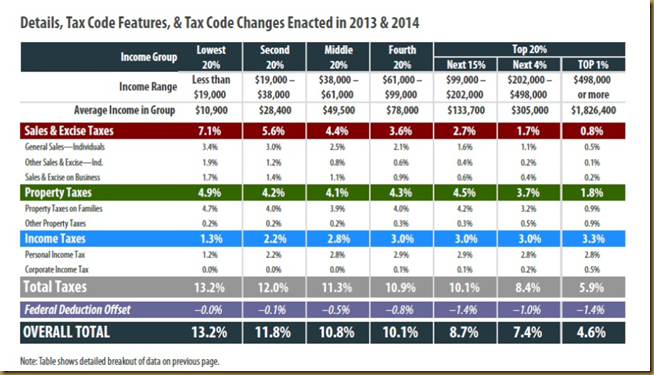

• The lower one’s income, the higher one’s overall effective state and local tax rate.Combining all state and local income, property, sales and excise taxes that Americans pay, the nationwide average effective state and local tax rates by income group are 10.9 percent for the poorest 20 percent of individuals and families, 9.4 percent for the middle 20 percent and 5.4 percent for the top 1 percent.

• In the 10 states with the most regressive tax structures (the Terrible 10) the bottom 20 percent pay up to seven times as much of their income in taxes as their wealthy counterparts. Washington State is the most regressive, followed by Florida, Texas, South Dakota, Illinois, Pennsylvania, Tennessee, Arizona, Kansas, and Indiana.

• Heavy reliance on sales and excise taxes are characteristics of the most regressive state tax systems. Six of the 10 most regressive states derive roughly half to two-thirds of their tax revenue from sales and excise taxes, compared to a national average of roughly one-third . Five of these states do not levy a broad-based personal income tax (four do not have any taxes on personal income and one state only applies its personal income tax to interest and dividends) while four have a personal income tax rate structure that is flat or virtually flat.

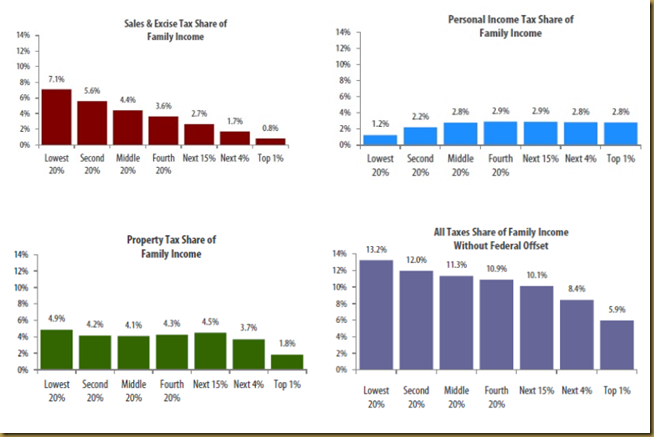

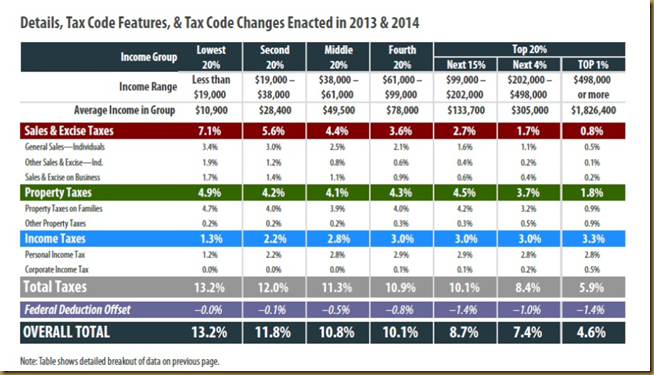

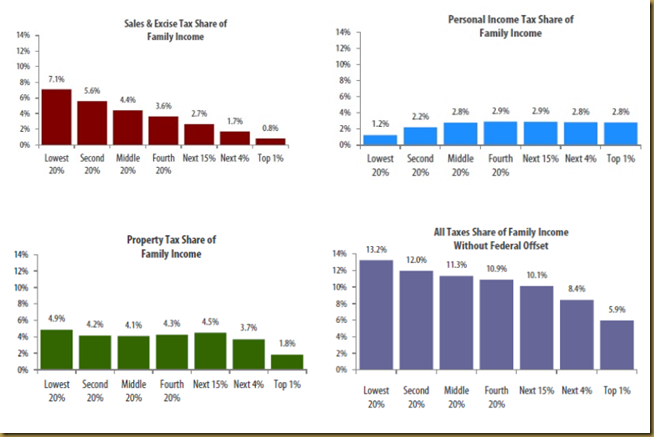

• State personal income taxes are typically more progressive than the other taxes that states levy (e.g property, consumption). Sales and excise taxes are the most regressive, with poor families paying almost eight times more of their income in these taxes than wealthy families, and middle income families paying five times more. Property taxes are typically regressive as well, but less so than sales and excise taxes.

• Personal income taxes vary in fairness due to differences in rates, deductions, and exemptions across states. For example, the Earned Income Tax Credit improves progressivity in 25 states and the District of Columbia, while nine states undermine progressivity by allowing taxpayers to pay a reduced rate on capital gains income, which primarily benefits higher-income households.

• State consumption tax structures are highly regressive with an average 7 percent rate on sales and excise taxes for the poor, a 4.7 percent rate for middle-income people, and a 0.8 percent rate for the wealthiest taxpayers. Because food is one of the largest expenses for low-income families, taxing food is particularly regressive; five of the ten most regressive states tax food at the state or local level.

• Taxes on personal and business property are a significant revenue source for both states and localities and are generally regressive in their overall effect, particularly for middle-income households. A homestead exemption (exempting a flat dollar or percentage amount of property value from a property tax) lessens regressivity. A property tax circuit breaker that caps the amount a property owner pays in property taxes based on their personal income can also reduce regressivity; none of the 10 most regressive states offer this tax break to low-income families of all ages.

• States commended as “low tax” are often high tax states for low- and middle-income families. The 10 states with the highest taxes on the poor are Arizona, Arkansas, Florida, Hawaii, Illinois, Indiana, Pennsylvania, Rhode Island, Texas, and Washington. Seven of these are also among the “terrible ten” because they are not only high tax for the poorest, but low tax for the wealthiest.

Read more go to: Executive Summary | The Institute on Taxation and Economic Policy (ITEP)

More Illinois facts:

Illinois: Gov. Pat Quinn lost his bid for reelection to businessman Bruce Rauner. Taxes were a big issue in this campaign. Rauner’s position on how to handle the state’s temporary 5 percent income tax rate changed through the campaign. (The state’s temporary 5 percent income tax rate is set to fall to 3.75 percent in January). Initially he proposed allowing the temporary income tax hike to immediately expire, but he changed his position once the reality set in that as governor he would need to fill the $2 billion budget hole created by allowing the tax rate to fall. More recently, Rauner has said that he will allow the temporary tax increase to expire over four years and will keep property taxes at their current level. Rauner would make up $600 million of lost income tax revenue by broadening the sales tax base to include many business services such as advertising, printing and attorney fees. The Illinois House and Senate, which remain under Democratic control, may tackle the temporary income tax rate before Rauner takes office. Regardless, Illionois will be a state to watch in 2015 given the governor’s stand on taxes, divided government and overwhelming voter approval of a referendum showing support for a millionaire’s tax.