The following tax rate comparison was presented at the June 22, 2011 District 100 school board meeting. Belvidere has the lowest rate in Winnebago-Boone Counties. Is District 100 Board of Education thinking about asking for an increase in the education tax rate?

Click on the photocopy to enlarge:

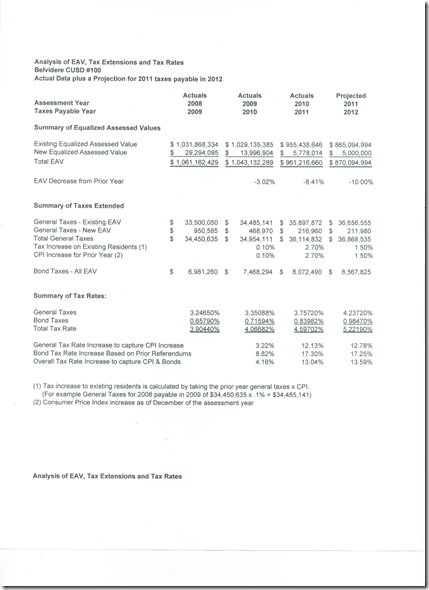

Belvidere’s 4.59702 rate is a substantially higher rate than the prior year’s 4.06682 and is projected to be up to 5.22190 for next tax year See the document shown below from the May 16, 2011 District 100 board meeting. In percentage terms this year’s tax rate went up 13.04%; next year is projected to increase 13.59%. An individual home’s tax increase should be somewhat less because assessed values (EAV) are projected to decrease 10% for 2011-2.

Assuming the projected 5.22190 rate to be correct—Belvidere will still have the lowest rate in 2011-2 but the gap maybe narrowing. Also note the largest increase is in Bond Taxes (17.3% for 2010-11). Much larger increases in Bond Taxes will occur in upcoming years not yet shown in 2011-2.

Here is proof that other districts are thinking of increases.