Will the 1 per cent sales PSB tax end in 2018?

The $9.3 million bond was originally issued in 1999 to help pay for the county jail. It is set to expire in 2018.

Additionally, the board received an Aa2 bond rating from Moody’s Investors Service, which is the third highest bond rating offered by the agency. To receive that rating, County Administrator Ken Terrinoni met with representatives from Moody’s Investors Service, who interviewed him about the county’s finances for an hour.

“We gave them a full picture of our finances, and they were mostly questioning the ways we got through this recent recession,” he said.

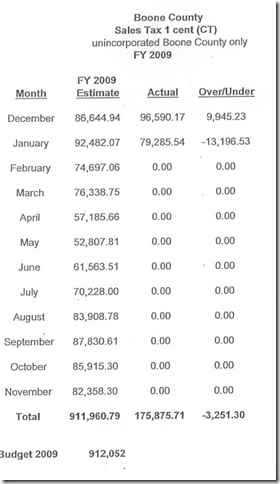

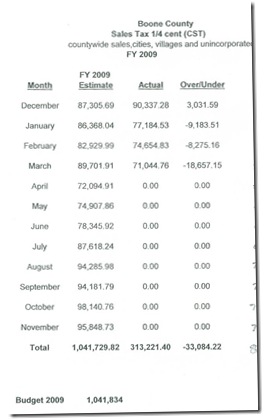

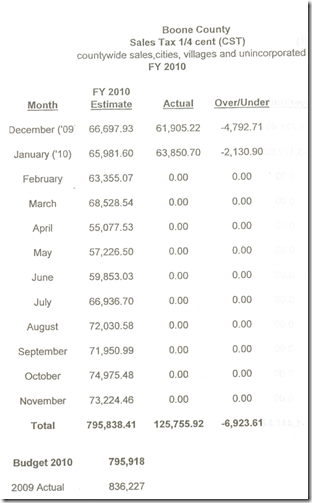

The agency said the county’s strengths included a strong and conservative management team, as well as having a healthy reserve level. One of its weaknesses included relying on sales tax revenues.

Boone County saves thousands from refinancing jail bond - Rockford, IL - Rockford Register Star