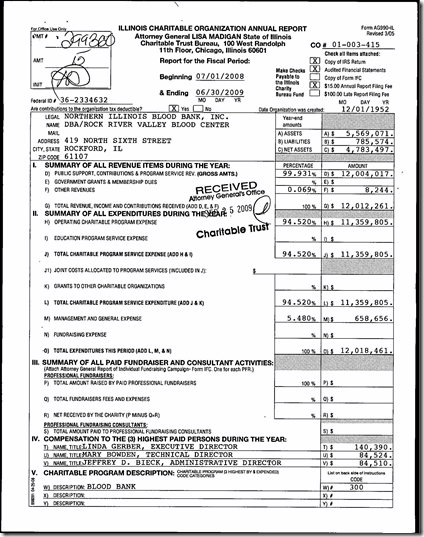

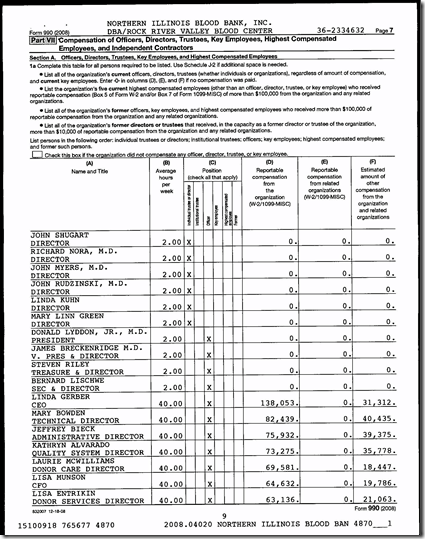

Linda Gerber, Executive Director received $169,365 in salaries, deferred compensation and non-taxable income for the tax year 2009(see last photocopy) plus $31,312 in compensation from a related organization(see 2nd photocopy). A total of $200,677 as of 12-31-2009.

Look at 2nd & 3rd photocopy concerning related organization compensation. Including Ms. Gerber there are four Blood Bank employees receiving combined compensation exceeding $100,000 and four in the high $90,000’s.

This information along with the audited financial statements of the charity are available at:

http://www.illinoisattorneygeneral.gov/charities/search/index.jsp

The proper name of the organization for search purposes is:

NORTHERN ILLINOIS BLOOD BANK INC

Reg. Number:

01003415

EIN:

362334632

Click on the following photocopy for more details:

Employee Compensation from Related Organization.

Non-Taxable and Deferred Compensation

No comments:

Post a Comment