Do you have a moral obligation to pay for your parent's long-term care? Is it your duty as an adult child to financially support your elderly parent when your parent runs out of his or her own money?

Most people want to be there for their parents, emotionally and financially. However, the children of an elderly parent are typically saving for their own retirement, putting their own children through college, and paying off their own mortgage. They may want to help their parent financially, but have other priorities for their money.

If your neighbor is in a nursing home and runs out of his own money, should you pay for his care? Or should that obligation fall to his children if they can afford to pay?

Thirty states now have laws that look to adult children to assist in the financial support of a parent. Massachusetts is one of 12 states that actually have made it a crime, punishable by fine or imprisonment, for an adult child to refuse to support a needy parent. Tennessee has such a law, but it lies dormant at this time.

States With Filial Responsibility Laws

States with filial responsibility laws are: Alaska, Arkansas,

California, Connecticut, Delaware, Georgia, Idaho, Indiana, Iowa,

Kentucky, Louisiana, Maryland, Massachusetts, Mississippi, Montana,

Nevada, New Hampshire, New Jersey, North Carolina, North Dakota,

Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota,

Tennessee, Utah, Vermont, Virginia, and West Virginia.

To look up the actual language of the statutes, here are the

citations:

1. Alaska Stat. 25.20.030, 47.25.230 (Michie 2000)

2. Arkansas Code Ann. 20-47-106 (Michie 1991)

3. California Fam. Code 4400, 4401, 4403, 4410-4414 (West 1994),

California Penal Code 270c (West 1999), California Welf. & Inst.

Code 12350 (West Supp. 2001)

4. Connecticut Gen. Stat. Ann. 46b-215, 53-304 (West Supp. 2001)

5. Delaware Code Ann. tit. 13, 503 (1999)

6. Georgia Code Ann. 36-12-3 (2000)

7. Idaho Code 32-1002 (Michie 1996)

8. Indiana Code Ann. 31-16-17-1 to 31-16-17-7 (West 1997); Indiana

Code Ann. 35-46-1-7 (West 1998)

9. Iowa Code Ann. 252.1, 252.2, 252.5, 252.6, 252.13 (West 2000)

10. Kentucky Rev. Stat. Ann. 530.050 (Banks-Baldwin 1999)

11. Louisiana Rev. Stat. Ann. 4731 (West 1998)

12. Maryland Code Ann., Fam. Law 13-101, 13-102, 13-103, 13-109

(1999)

13. Massachusetts Gen. Laws Ann. ch. 273, 20 (West 1990)

14. Mississippi Code Ann. 43-31-25 (2000)

15. Montana Code Ann. 40-6-214, 40-6-301 (2000)

16. Nevada Rev. Stat. Ann. 428.070 (Michie 2000);

Nev. Rev. Stat. Ann. 439B.310 (Michie 2000)

17. New Hampshire Rev. Stat. Ann. 167:2 (1994)

18. New Jersey Stat. Ann. 44:4-100 to 44:4-102, 44:1-139 to 44:1-

141 (West 1993)

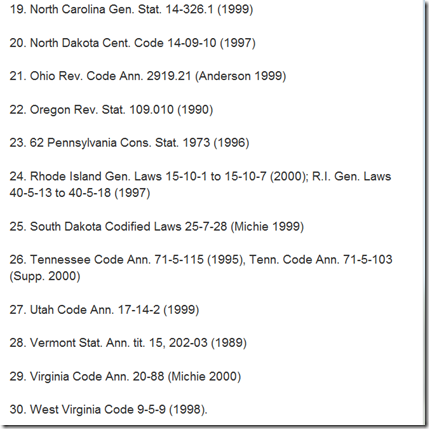

19. North Carolina Gen. Stat. 14-326.1 (1999)

20. North Dakota Cent. Code 14-09-10 (1997)

21. Ohio Rev. Code Ann. 2919.21 (Anderson 1999)

22. Oregon Rev. Stat. 109.010 (1990)

23. 62 Pennsylvania Cons. Stat. 1973 (1996)

24. Rhode Island Gen. Laws 15-10-1 to 15-10-7 (2000); R.I. Gen.

Laws 40-5-13 to 40-5-18 (1997)

25. South Dakota Codified Laws 25-7-28 (Michie 1999)

26. Tennessee Code Ann. 71-5-115 (1995), Tenn. Code Ann. 71-5-

103 (Supp. 2000)

27. Utah Code Ann. 17-14-2 (1999)

28. Vermont Stat. Ann. tit. 15, 202-03 (1989)

29. Virginia Code Ann. 20-88 (Michie 2000)

30. West Virginia Code 9-5-9 (1998).

State laws vary. owever, law student Shannon Edelstone, in her

award-winning essay (cited below), studied all of the state laws and

found that most agree that children have a duty to provide

necessities for parents who cannot do so for themselves. The states'

legislation also gives guidelines to the courts, telling judges to use a

number of factors when weighing the adult child's ability to pay

against the indigent parent's needs. Judges, accordingly, have

considered such variables as the adult child's financing of their

child's college education, as well as his/her personal needs for

savings and retirement.

Sources: Filial Responsibility: Can the Legal Duty to Support Our

Parents Be Effectively Enforced? by Shannon Frank Edelstone,

appearing in the Fall 2002 issue of the American Bar Association's

Family Law Quarterly, 36 Fam. L.Q. 501 (2002). Lexic.com

Here is the apparent proper resource source:

Click on the following for more details: Filial Responsibility Laws - List of States Having Them ~ Everyday Simplicity

3 comments:

You know - - I agree. We as a society have had no right to turn this function of caring for our elders over to "the system". And unlike some people, I am happy to help my folks.

But let's also take a look at what it costs to live in a nursing home. Assuming you don't have to have any nursing per se or are a threat and have to be on lock-down in an Alzheimer's ward, you generally get a pretty dingy room the size of a walk in closet, a grumpy nurse assistant to bring you pills twice a day, and some sub-par cafeteria food... all for about $5000 a month. Supplies are billed to you at costs that would indicate they were delivered to the facility on the backs of albino tigers. It is ridiculously expensive and beyond reason. Those who want to lower the guilt boom on people for not wanting to cover these absurd costs first need to look at the absurd costs to learn why. It isn't selfish of people to bristle at the idea of putting elderly parents into a room that has a lot in common with a Motel 6 but is priced more like the local Marriott.

Why should an adult child be responsible for a parent who made poor lifestyle and financial decisions his/her entire life. My father is long time smoker with a history of alcohol abuse; who did not exercise, did not eat well and ignored advice from family, friends and physicians. I offered to take over his private insurance payments. He refused and cancelled the policy because he could not afford it. I offered to pay for Chantix, he refused. I offered physical therapy when his mobility was becoming an issue, he refused. He is now not able to live independently. I'm helping with the Medicaid application and I pay my taxes. I shouldn't have to take money out of my kids college fund or our retirement plan over something I had no control over and for someone who refused my help when it could have made a difference.

Perhaps if insurance companies put more coverage into preventative medicine some of these issues/costs could be mitigated in the future.

Why should an adult child be responsible for a parent who made poor lifestyle and financial decisions his/her entire life. My father is long time smoker with a history of alcohol abuse; who did not exercise, did not eat well and ignored advice from family, friends and physicians. I offered to take over his private insurance payments. He refused and cancelled the policy because he could not afford it. I offered to pay for Chantix, he refused. I offered physical therapy when his mobility was becoming an issue, he refused. He is now not able to live independently. I'm helping with the Medicaid application and I pay my taxes. I shouldn't have to take money out of my kids college fund or our retirement plan over something I had no control over and for someone who refused my help when it could have made a difference.

Perhaps if insurance companies put more coverage into preventative medicine some of these issues/costs could be mitigated.

Post a Comment