I have received the various handouts from the Finance Committee meeting of March 10, 2009. I did not attend the meeting but from the worksheets and information that I gather, it appears that a revised budget is beginning to be constructed based upon the current recession conditions.

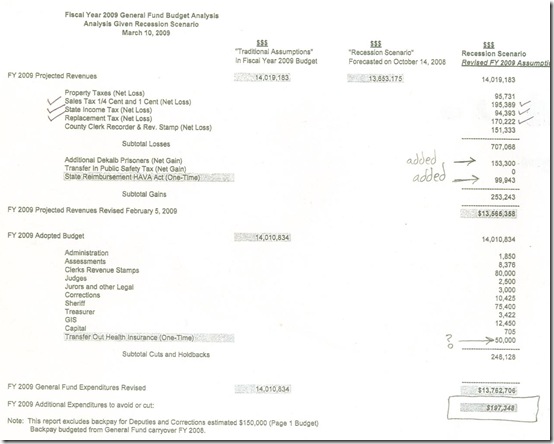

Below is the summary sheet of of the current monetary objectives which the Finance Committee and various departments will apparently use to arrive at a revised budget. I would assume that once their details are worked out, the entire revised budget will be approved (amended) by the entire board. Inasmuch as the process will really begin after May 1, I do not foresee the revision being approved until late June or July by the county board. Hopefully some of the changes will actually be implement before then. For the most part my discussion will center on the first handout. If you desire you may click any of photocopies to enlarge them:

I believe it is always best to begin an explanation with where are we going? Well at the very bottom there is number which I have put a square around. This number is the amount of additional FY 2009 Expenditures to avoid or cut; the number is $197,348. Based upon projected increases and decreases in projected income (Top part of sheet) and $248,128 expenses already cut or held back, the budget should be balanced if $197,348 of additional savings or cuts can be found. Possibly a relatively easy process since that represents only 1.5% ($197348/$13,762706) of General Fund Expenditures as currently revised.

There have been some major changes in revenue assumptions and additions to the revenue side to obtain such a modest number. The items which I have “checked”at the top represent 4 of the 5 revenue sources which we have been reviewing monthly. For convenience I will add the new projection to our chart from March 17 and compared the first three months of actual revenue with the new projected revenue from these sources. As shown by the chart the new assumptions for sales type taxes, replacement tax and state income tax are very close to the revenue loss we have experience the last three months. We do not have the new projections for CTSB (Public Safety Tax). It is not directly accounted for by any of the worksheets, other than no transfer to the General Fund is anticipated now. I believe previously this non-general fund item(CTSB) was providing a sizeable transfer in; under the revised budget no transfer is anticipated.

The county is being saved from large cuts because of additional Prisoners from DeKalb, $153,300, and a one time reimbursement from the HAVA Act, $99,943. Prisoner reimbursements in the past have at times been a problem because of unanticipated costs, hopefully this will not be true this time.

There are a number of facts which I do not understand. County Clerk Recorder & Rev Stamps represents both a loss of revenue of $151,333 and an effective gain of $80,000 for a curtailment of expenses. There also is the one time transfer out of Health Insurance of $50,000. I am sure some friends may help me on these small items.

The following are the other worksheets. All of the sheets are the income items. The major changes in income have for the most part been covered by the above analysis.

No comments:

Post a Comment